Depreciation Net Book Value Formula

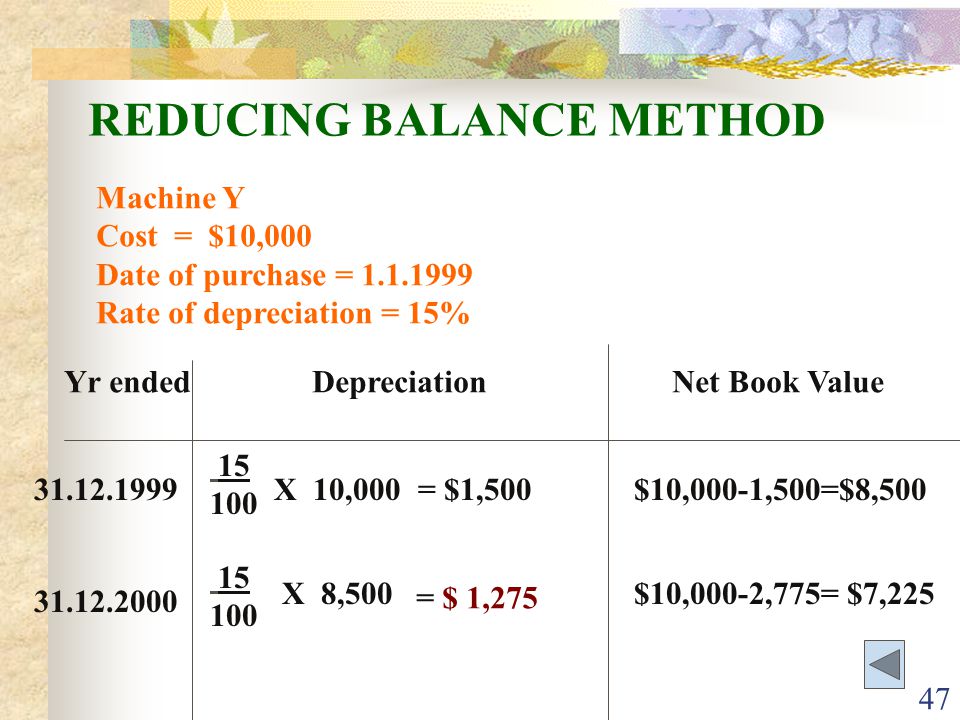

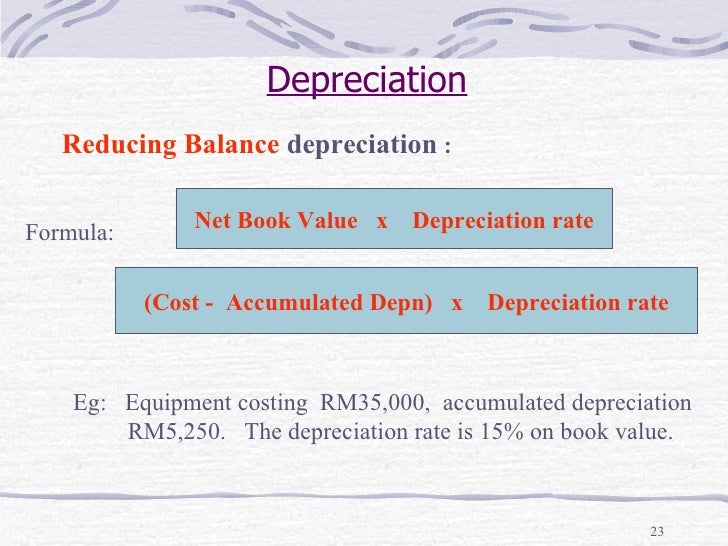

In year one the depreciation would be 6 000 40 000 x 15 percent.

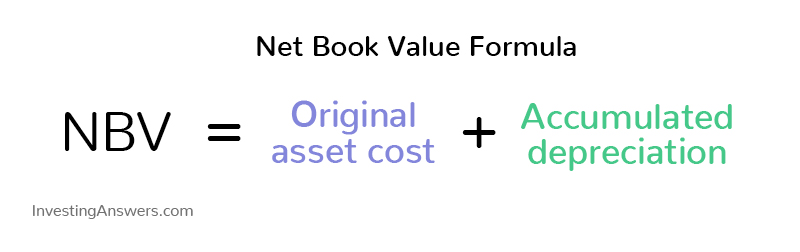

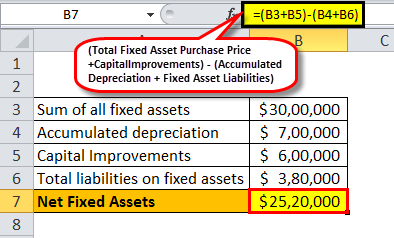

Depreciation net book value formula. Calculating net book value. Other cost include impairment cost and related costs. Under the straight line depreciation method the company would deduct 2 700 per year for 10 years that is 30 000 minus 3 000 divided by 10.

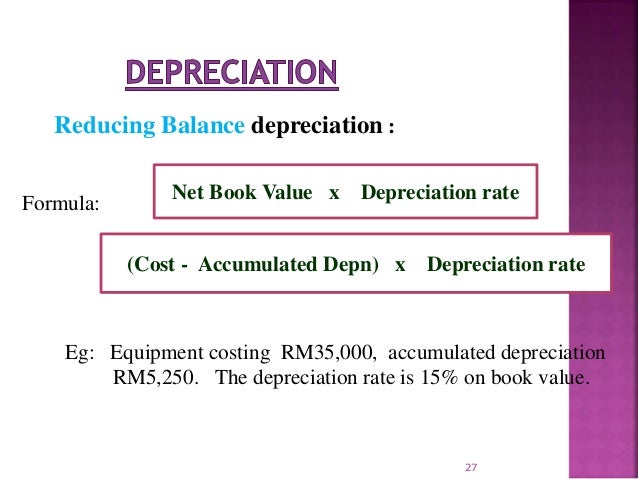

Diminishing balance method cost of an asset rate of depreciation 100 unit of product method cost of an asset salvage value useful life in the form of units produced. Nbv gross cost of asset accumulated depreciation let s start by calculating the original cost of an asset. Sample calculation of net book value.

The net book value after three years would be 40 000 6 000 5 100 4 335 or 24 565. The formula for calculating nbv is as follows. Depreciation periodic reduction in the value of the asset amortized as per standards.

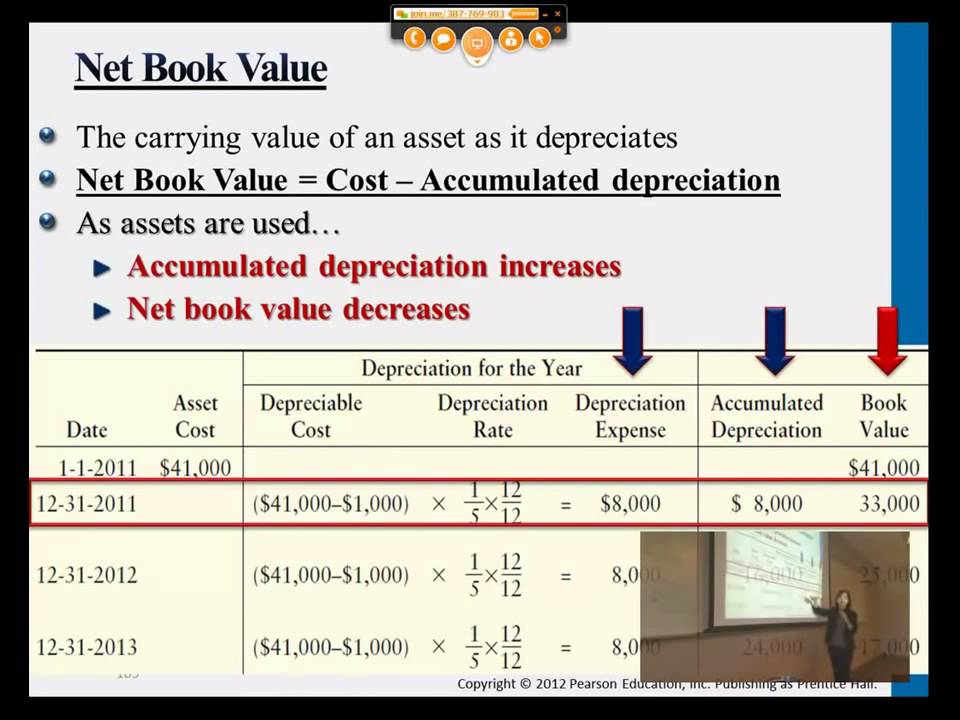

Note how the book value of the machine at the end of year 5 is the same as the salvage value. This will result in the book value of the asset. Total value of the asset value at which the asset is purchased.

Depreciation 2 straight line depreciation percent book value at the beginning of the accounting period. Accumulated depreciation per year depreciation x total number of years. The depreciation rate is the annual depreciation amount total depreciable cost.

In year two depreciation is 5 100 34 000 x 15 percent and in year three depreciation is 4 335 28 900 x 15 percent. As the name suggests it counts expense twice as much as the book value of the asset every year. The formula to calculate net book value is.