How Do You Find Book Value Of Equity

Book value of equity per share bvps is the ratio of equity available to common shareholders divided by the number of outstanding shares.

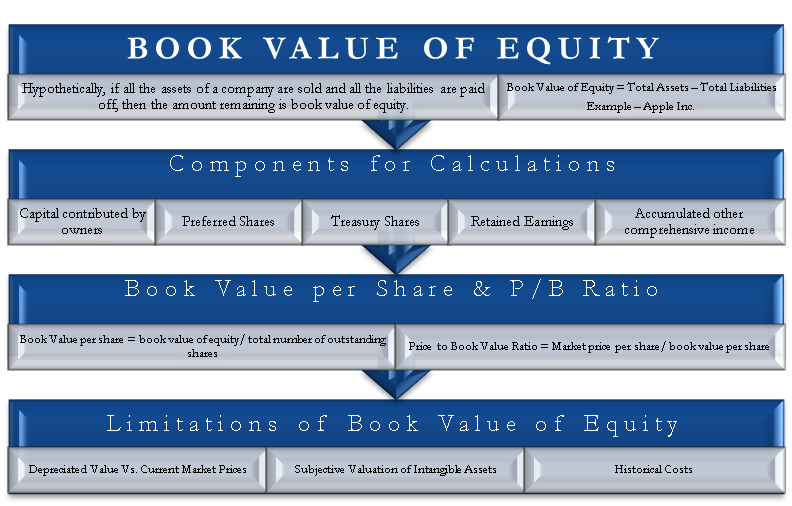

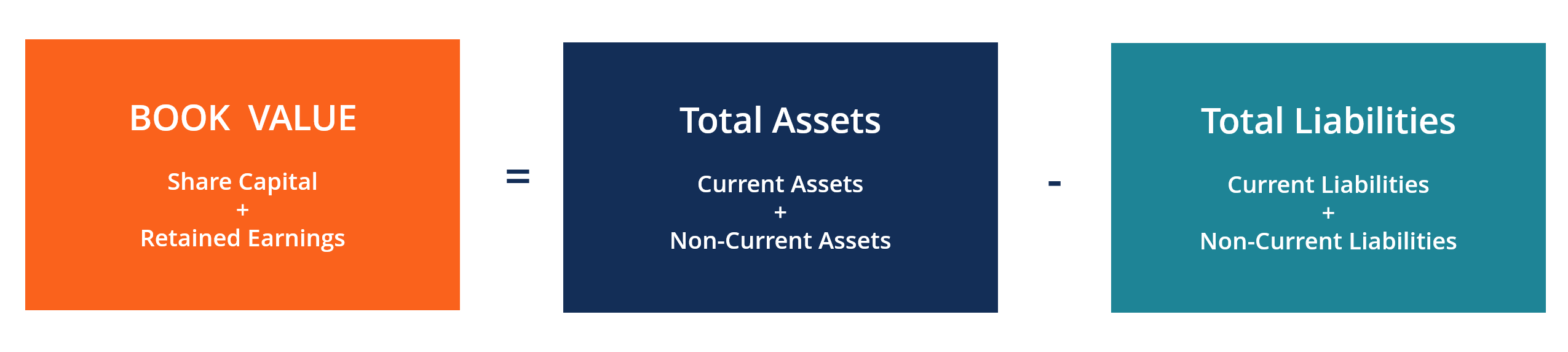

How do you find book value of equity. The term book value is a company s assets minus its liabilities and is sometimes referred to as stockholder s equity owner s equity shareholder s equity or simply equity. The formula for book value per share book value of equity total number of outstanding shares taking above example of apple inc we can calculate the book value per share as follows. For example in apple s 1q report released february 1 2018 the company reported total assets of 406 794 billion and liabilities of 266 595 billion.

Simply subtract liabilities from assets to arrive at book value. The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders. Further book value per share bvps can be computed based upon the equity of the common shareholders in the company.

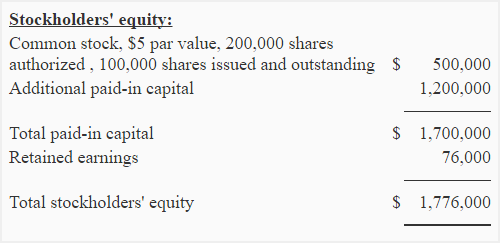

Based on the above formula calculation of book value of equity of rsz ltd can be done as 5 000 000 200 000 3 000 000 700 000 8 900 000 therefore the company s common equity is 8 900 000 as on the balance sheet date. Book value total common shareholders equity preferred stock number of outstanding common shares. You can find these figures on the balance sheet.

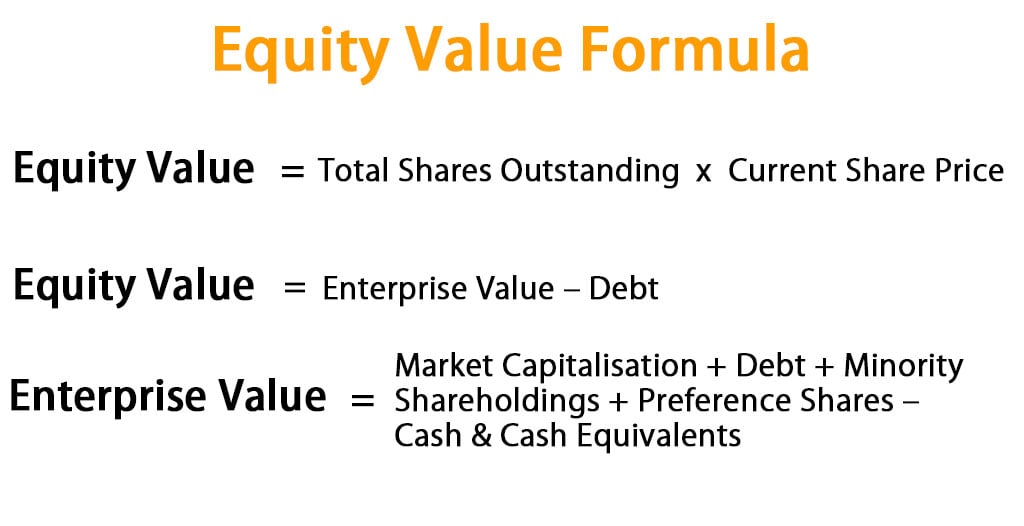

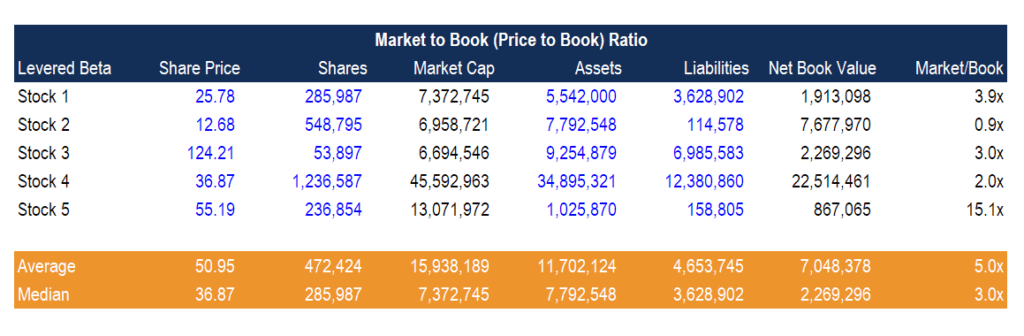

It is calculated by multiplying a company s share price by its number of shares outstanding whereas book value or shareholders equity is simply the difference between a company s assets and liabilities. The formula for calculating book value per share is the total common stockholders equity less the preferred stock divided by the number of common shares of the company. Assets are worth less if they must be liquidated in the short term and worth more if the seller can maximize the sale price over the long term.

The book value of equity is equal to total assets minus total liabilities preferred stocks and intangible assets. For healthy companies equity value far exceeds book value as the market value of the company s shares appreciates over the years. How to calculate book value.

This figure represents the minimum value of a company s. There are several variations on how to compute the book value of equity which are. Calculate book value of equity by subtracting a firm s total liabilities from its total assets to arrive at stockholders equity.

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)