Book Value Of Equity Meaning

The term book value derives from the.

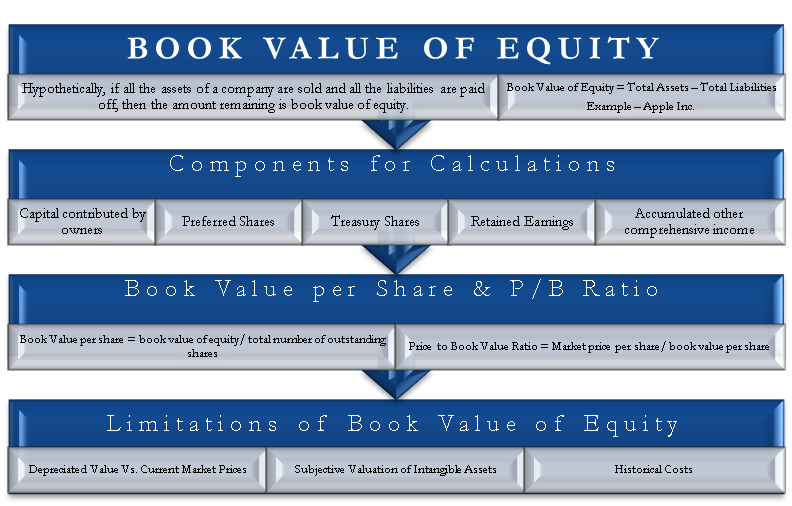

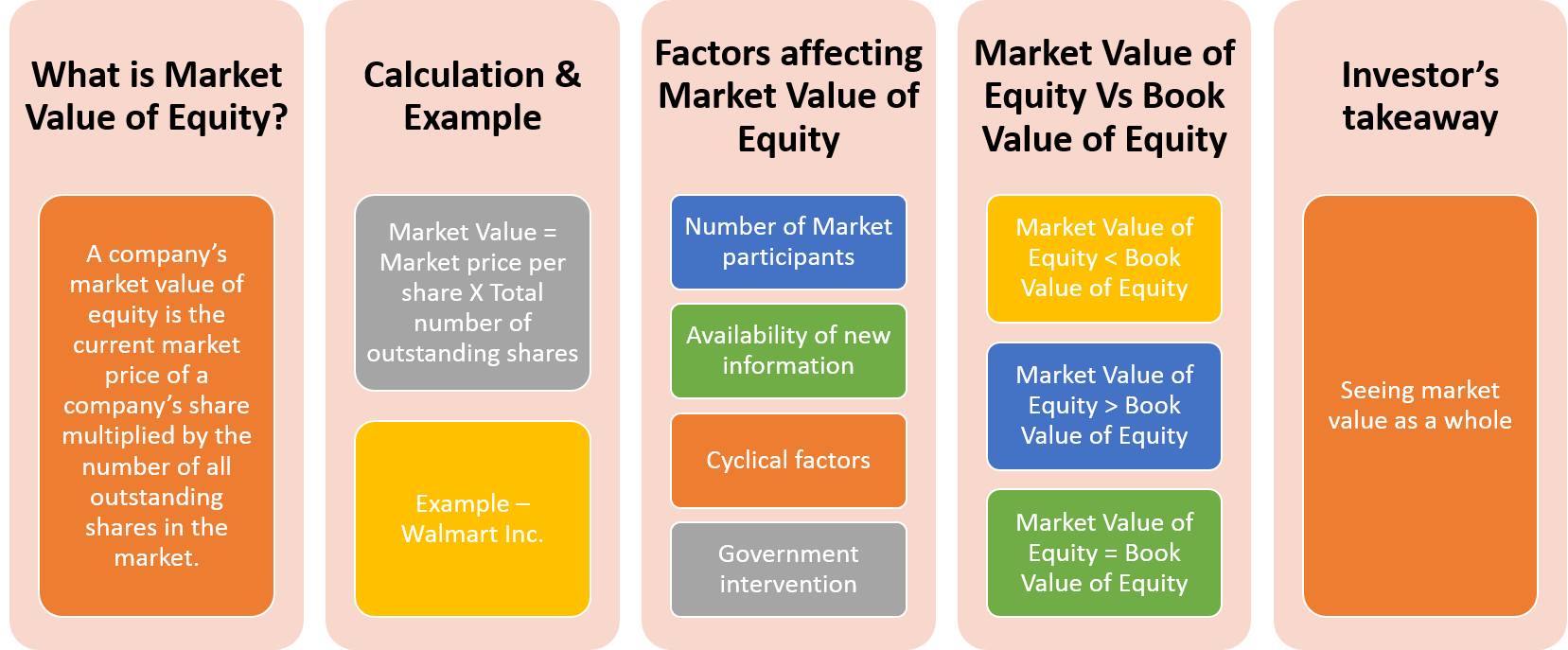

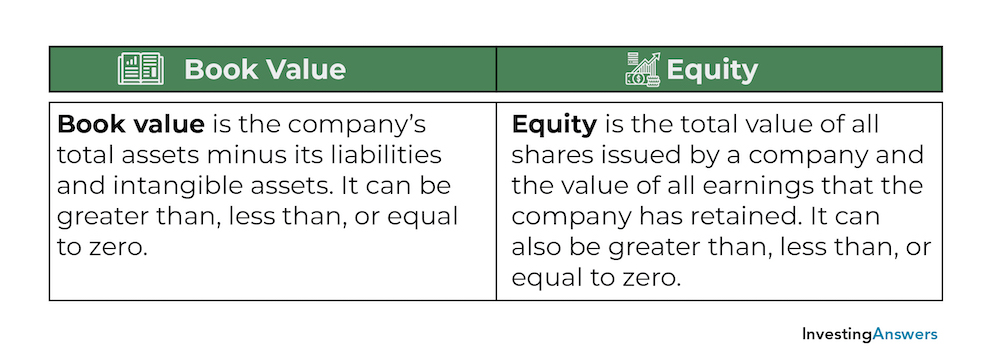

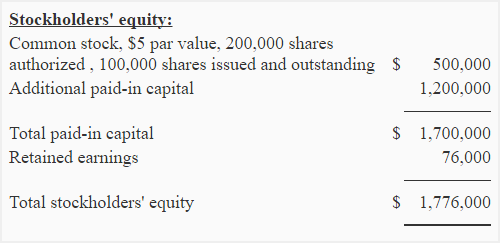

Book value of equity meaning. The book value of equity more widely known as shareholder s equity is the amount remaining after all the assets of a company are sold and all the liabilities are paid off. Book value of equity also known as shareholder s equity is a firm s common equity that represents the amount available for distribution to shareholders. Market value of equity vs book value of equity.

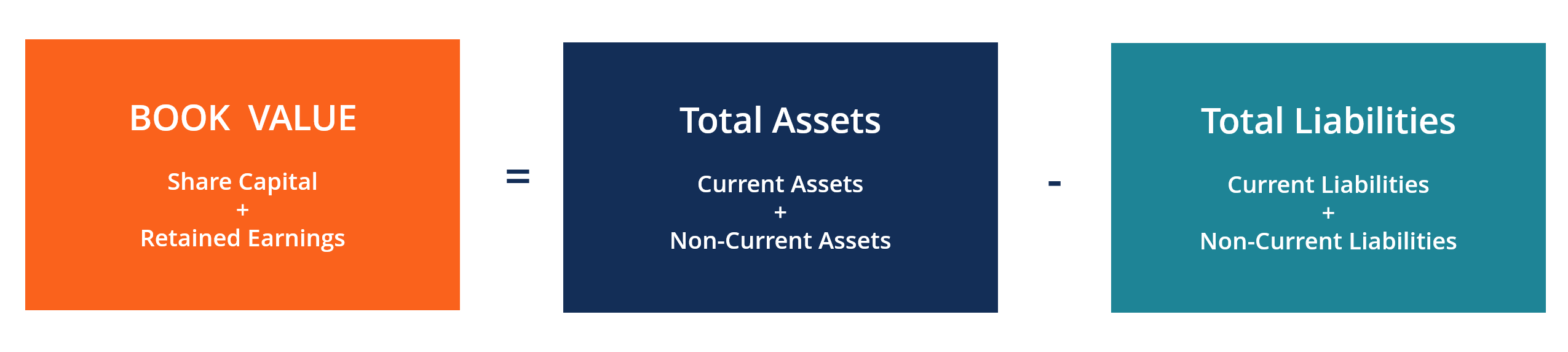

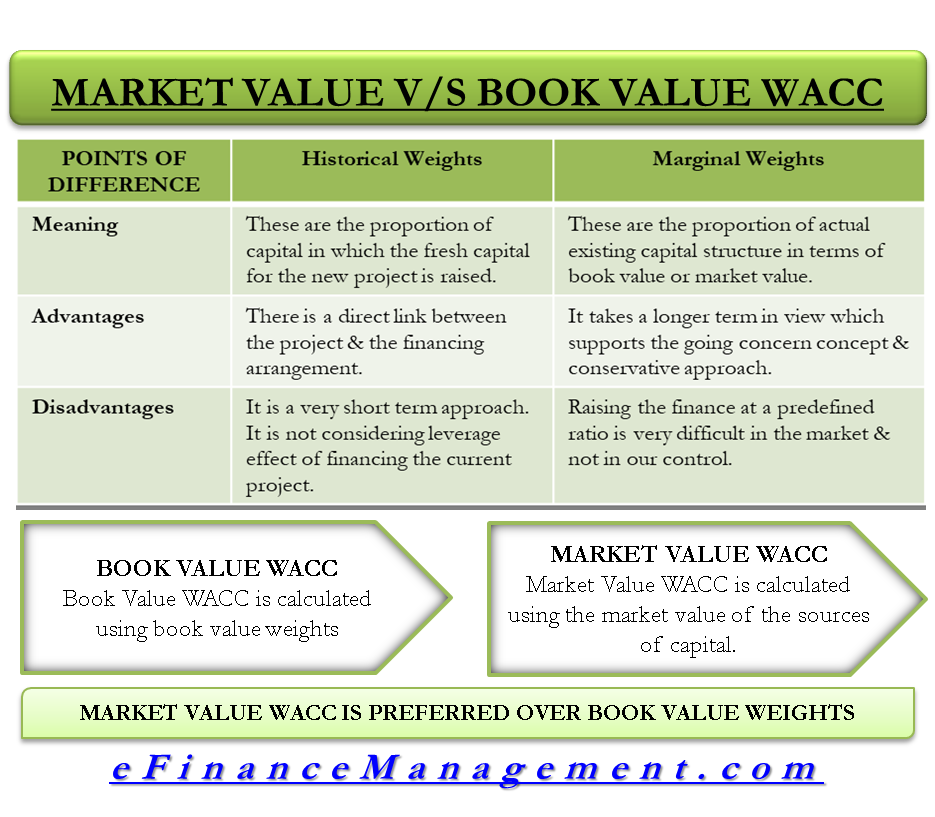

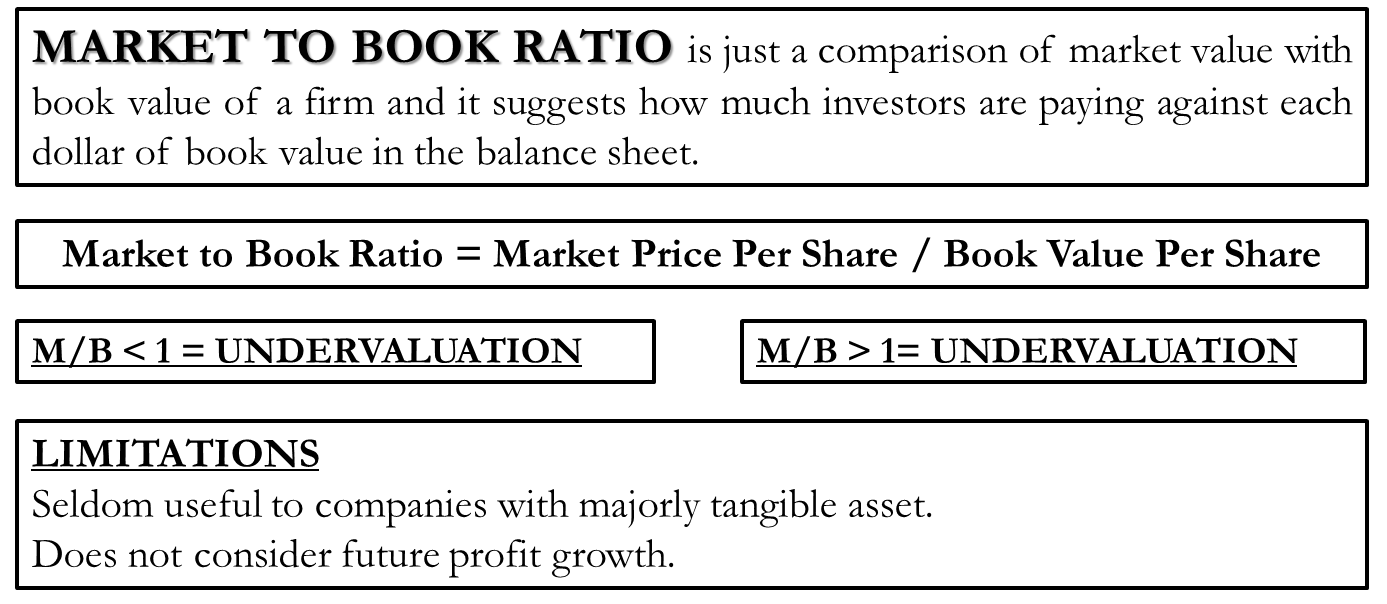

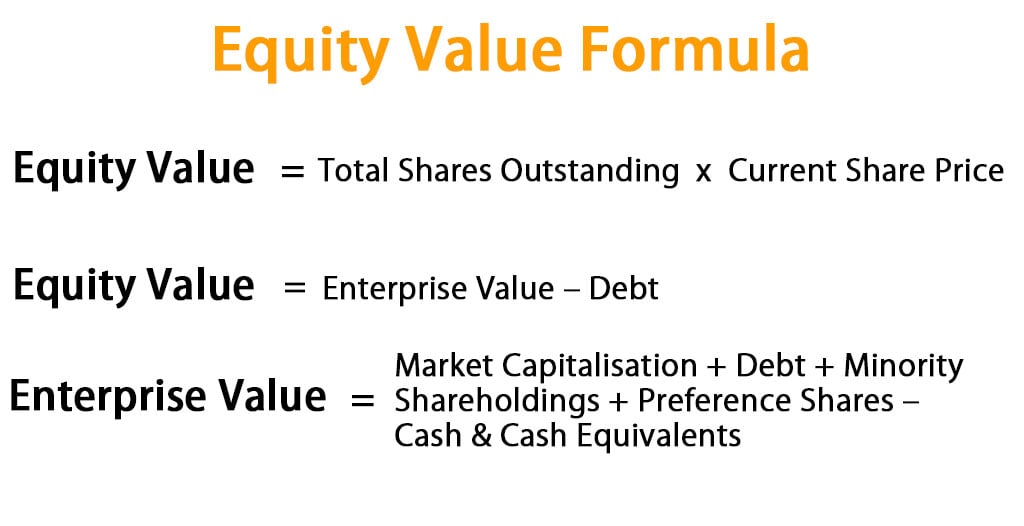

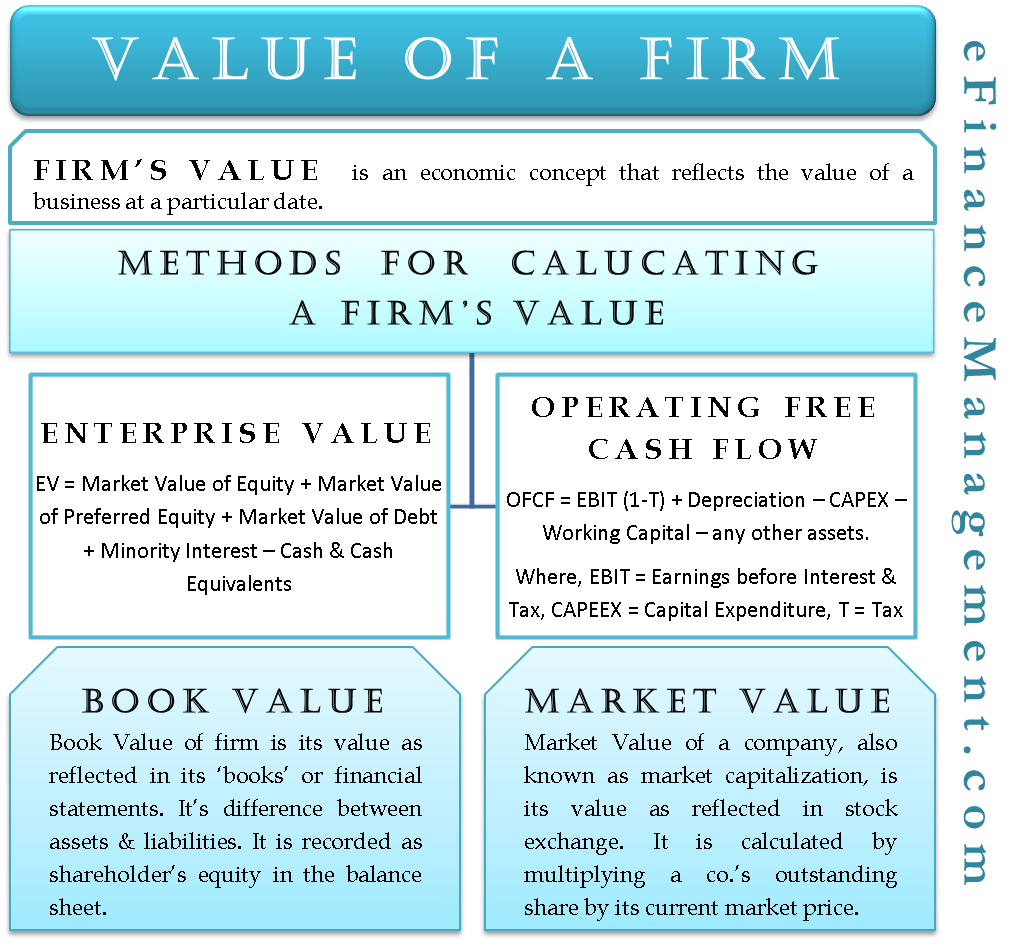

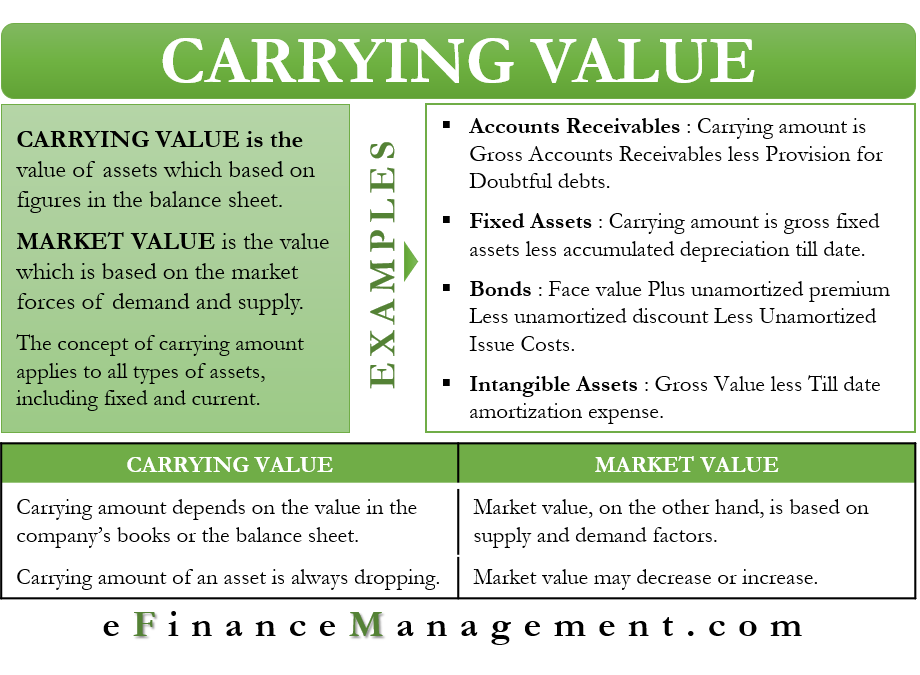

Book value is based on the amount the company has invested in its assets but not their current market value. Defining book value of equity book value of equity is an estimate of the minimum shareholders equity of a company. The equity value of a company is not the same as its book value.

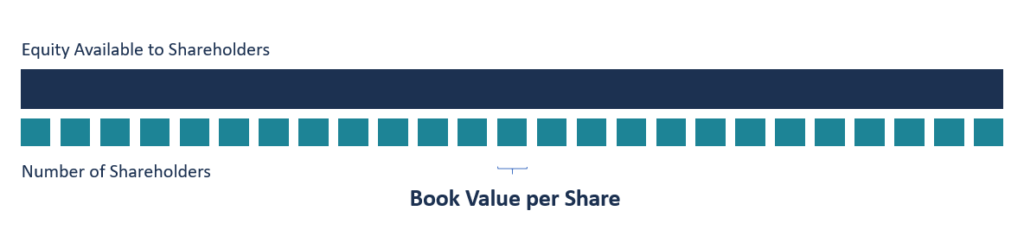

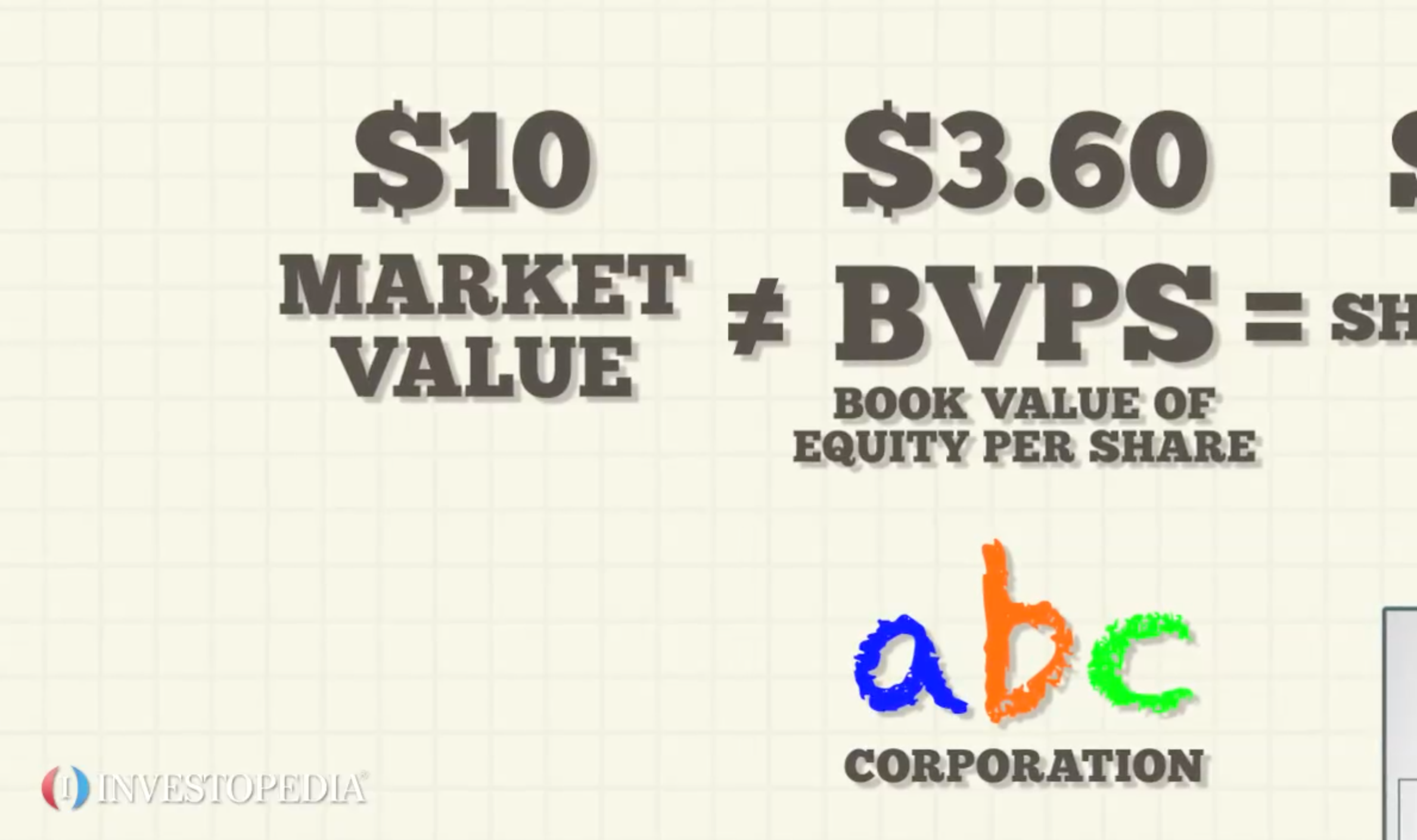

Book value of equity is an important concept because it helps in the interpretation of the financial health of a company or firm as it is the fair value of the residual assets after all the liabilities are paid off. Book value of equity per share effectively indicates a firm s net asset value total assets total liabilities on a per share basis. When a stock is undervalued it will have a higher book value.

Put another way if a company were to close its doors sell its assets and pay off its debts the book value of equity is theoretically the amount that would remain to be divided up among the shareholders. A company or corporation s book value as an asset held by a separate economic entity is the company or corporation s shareholders equity the acquisition cost of the shares or the market value of the shares owned by the separate economic entity. Book value of equity per share abbreviated as bvps is a company s available equity to common shareholders apportioned by the number of outstanding common shares.

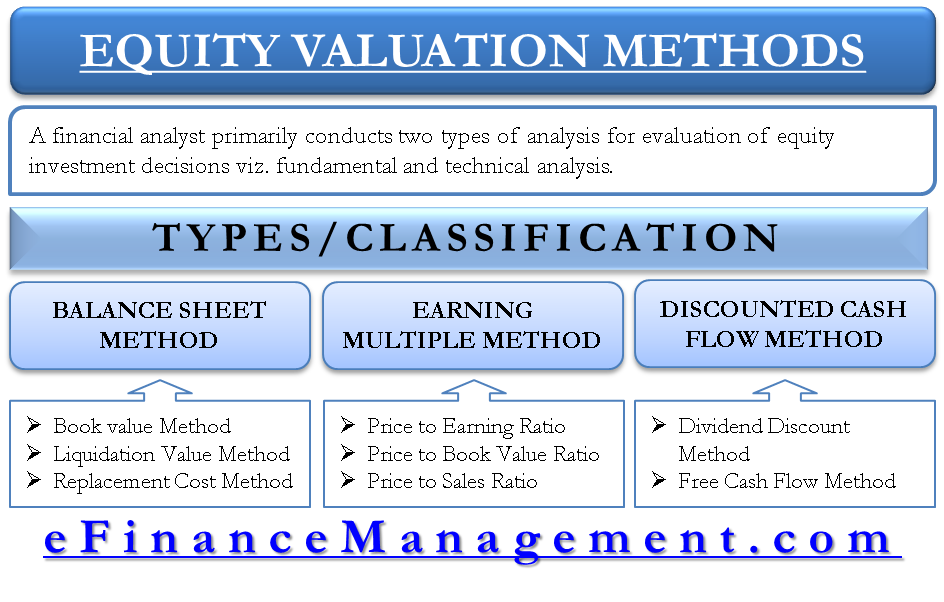

Though the assets are the sum up of all the company s both non current and current assets. From the perspective of an analyst or investor it is all the better if the balance sheet of the company is marked to market i e it captures the most current market value of the assets and the liabilities. This article has been a guide to what is book.

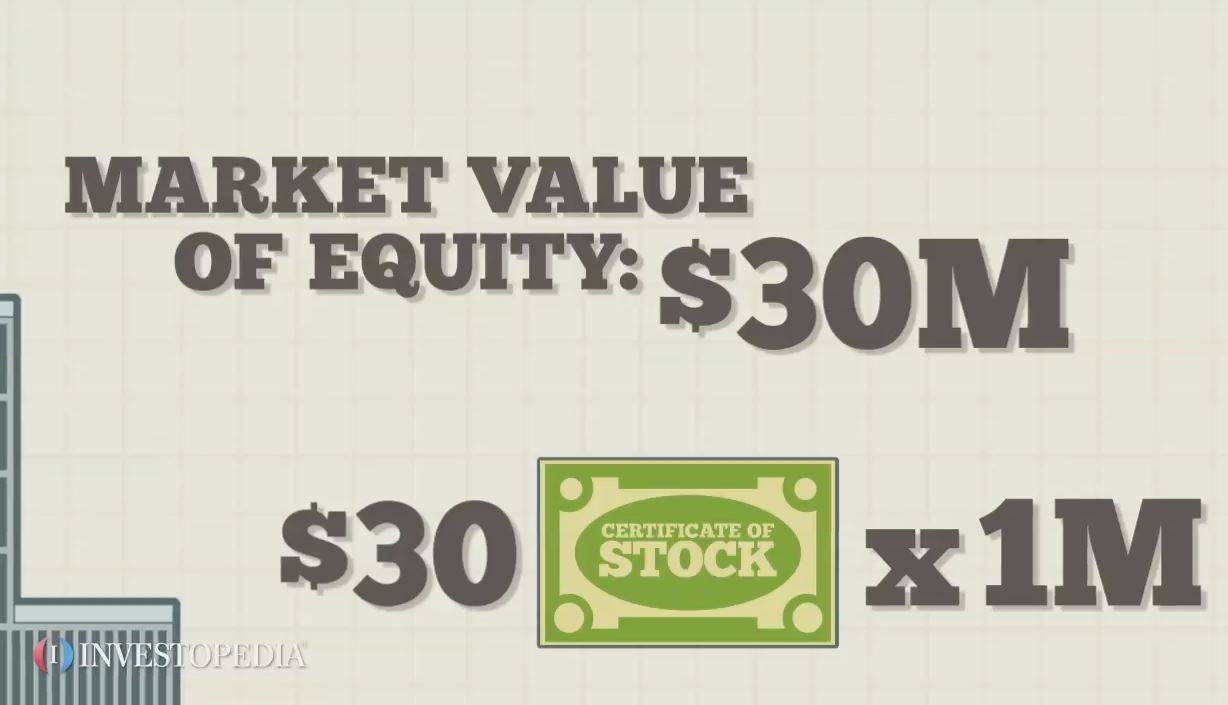

Book value of equity meaning. It is calculated by multiplying a company s share price by its number of shares outstanding whereas book value or shareholders equity is simply the difference between a company s assets and liabilities. Understanding book value book value is the accounting value of the company s assets less all claims senior to common equity such as the company s liabilities.