Book Value Debt Formula

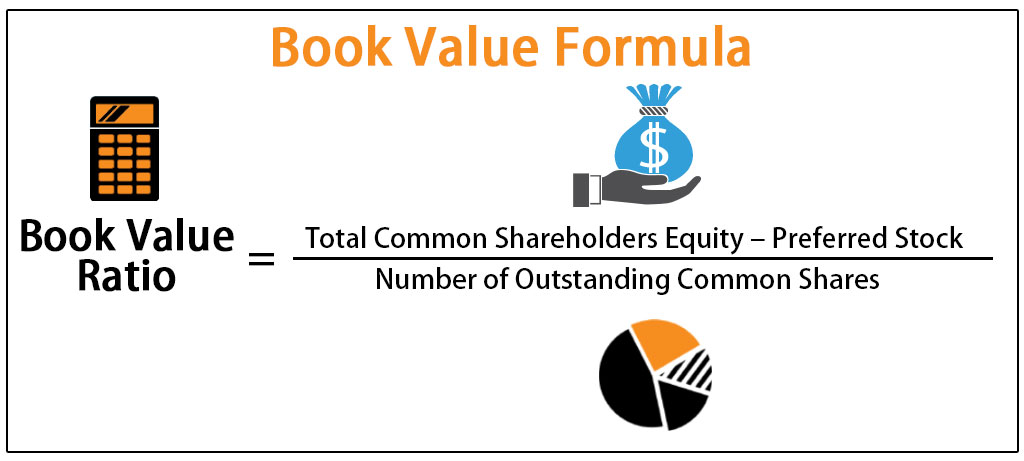

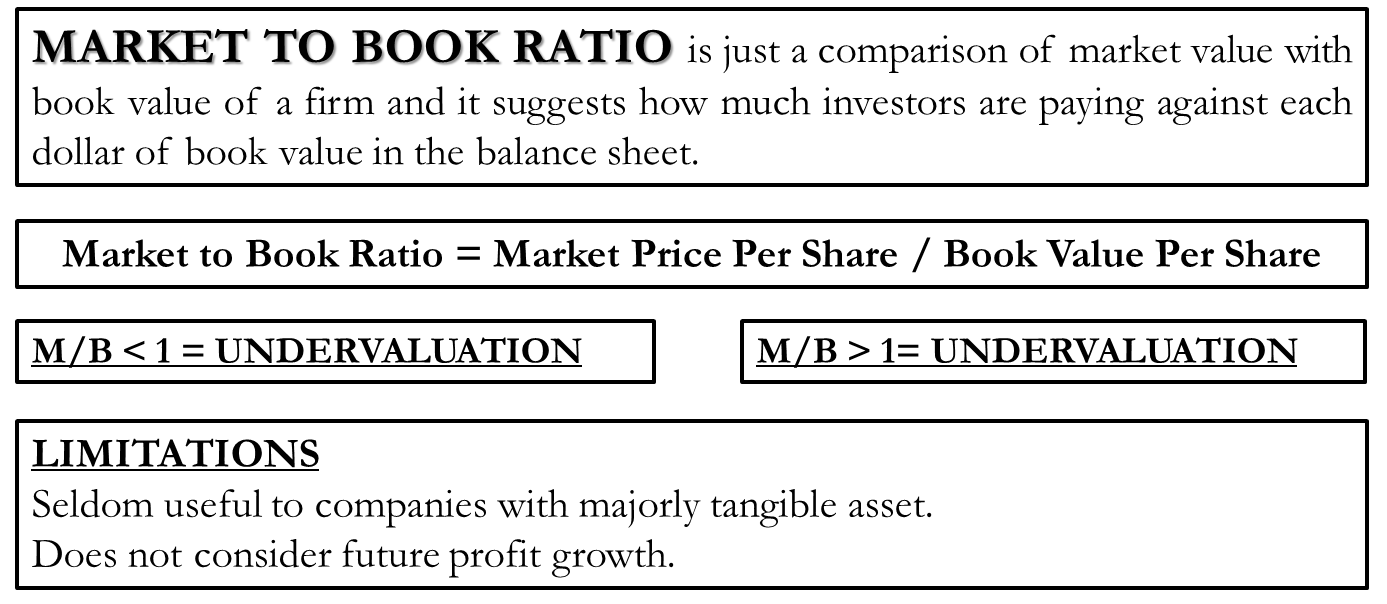

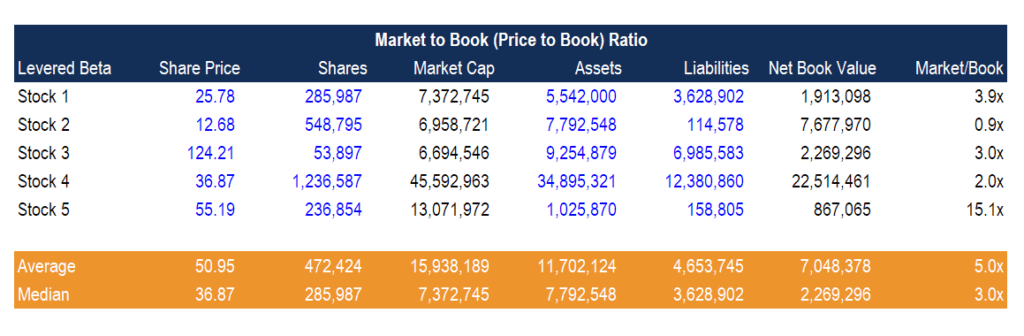

When compared to the current market value per share the book value per share can provide information on how a company s stock is valued.

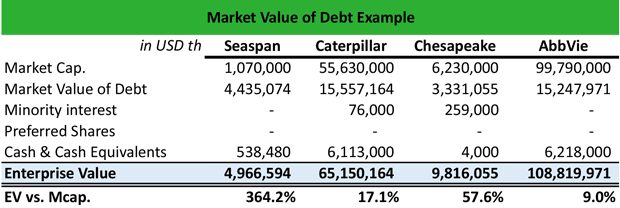

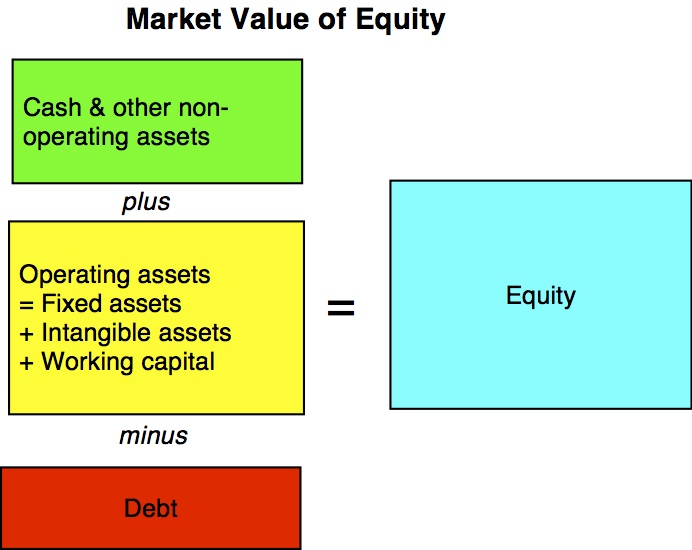

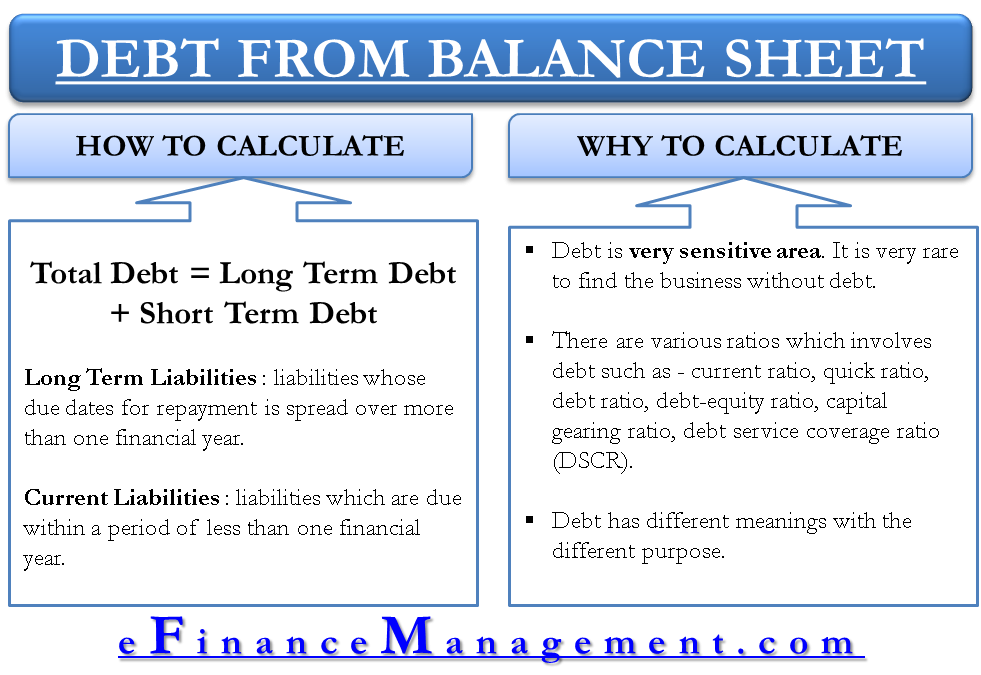

Book value debt formula. Once you know the book value divide the value of the debt by the assets. Found in the current liabilities section of the balance sheet. The formula for the market value of debt is e 1 1 1 r y r t 1 r y where e is the annual interest expense r is the cost of debt t is the total debt and y is the average maturity in years of the debt.

The risk is much higher than if liabilities were only 100 000. Now we will see amortization to calculate the cost of debt. If the result is higher than one that s a sign the company is carrying a large amount of debt.

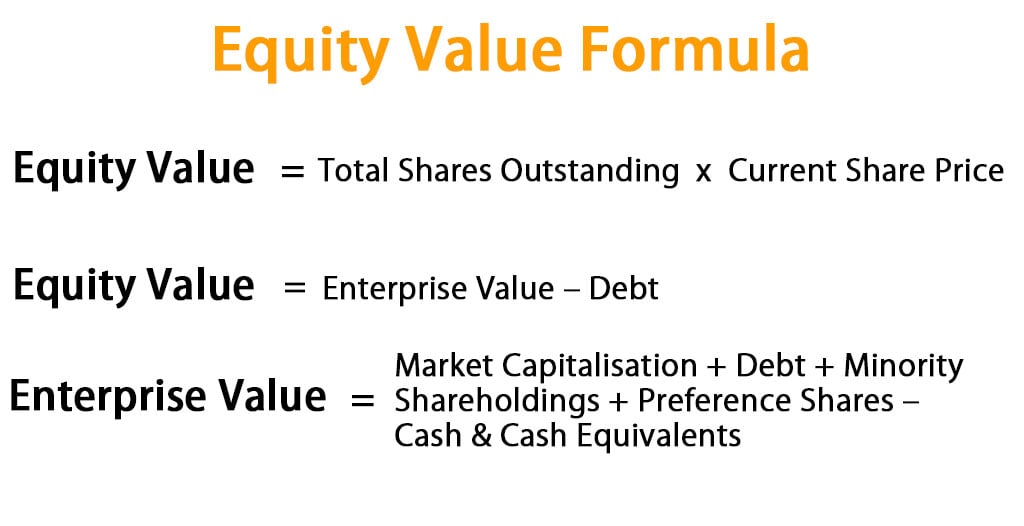

The formula for calculating book value per share is the total common stockholders equity less the preferred stock divided by the number of common shares of the company. A company named s m pvt. Current portion of long term debt.

The formula is given by. C 1 1 1 kd t kd fv 1 kd t. Found in the long term liabilities section of the balance sheet.

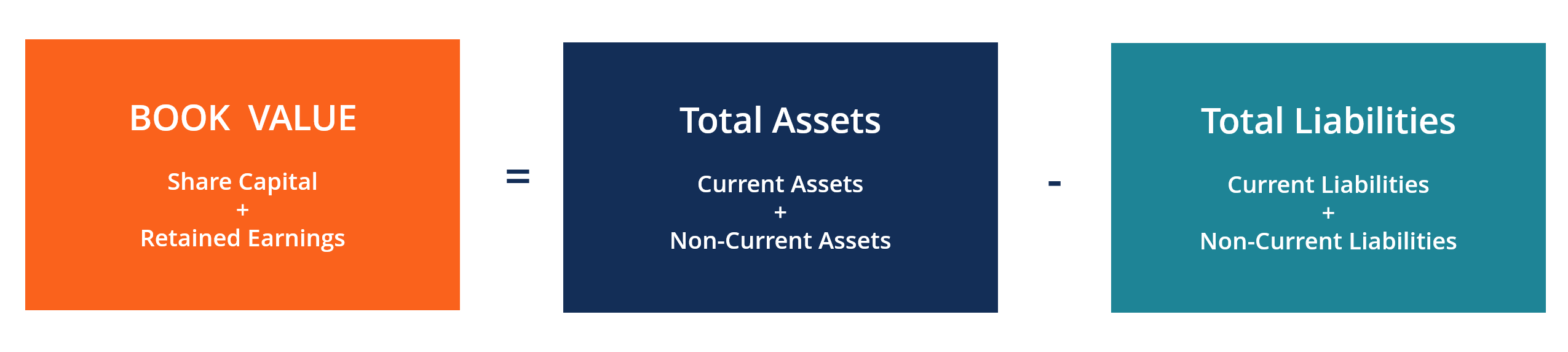

3 z x 1 t 1 x 2 t 2 x. The book value of debt is comprised of the following line items on an entity s balance sheet. Found in the current liabilities section of the balance sheet.

Book value of equity formula it is calculated by adding the owner s capital contribution treasury shares retained earnings and accumulated other incomes. For example suppose the company has 200 000 in assets and 250 000 in liabilities giving it a 1 25 debt ratio. However calculating the market value of debt can be tricky because not many firms carry their debt in bond form.

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)