Tangible Book Value Per Share Negative

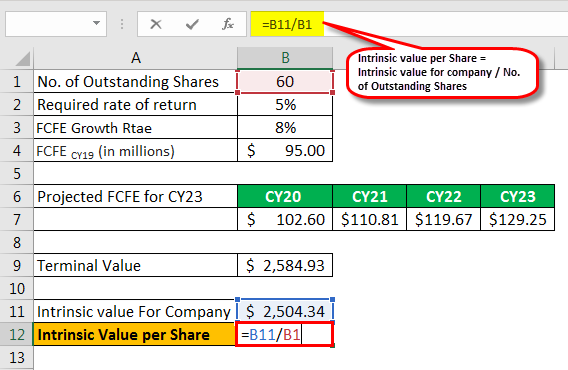

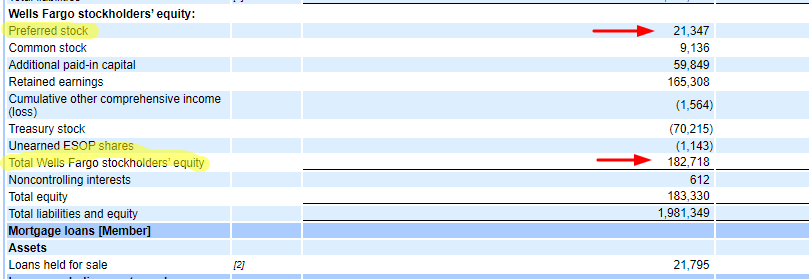

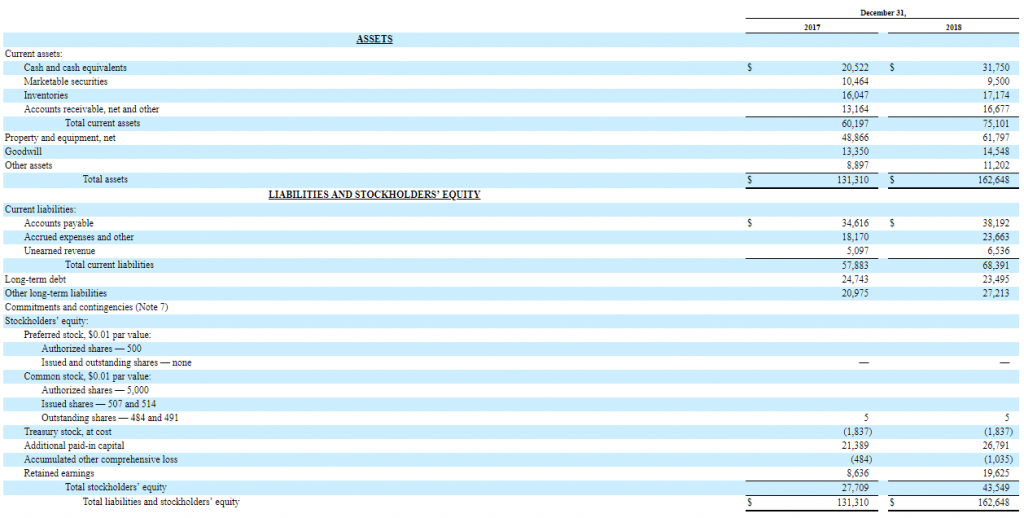

In reviewing hnna s balance sheet for 2019 i used the other intangibles of 80 6m in calculating the tangible book value per share resulting in a negative tbvps.

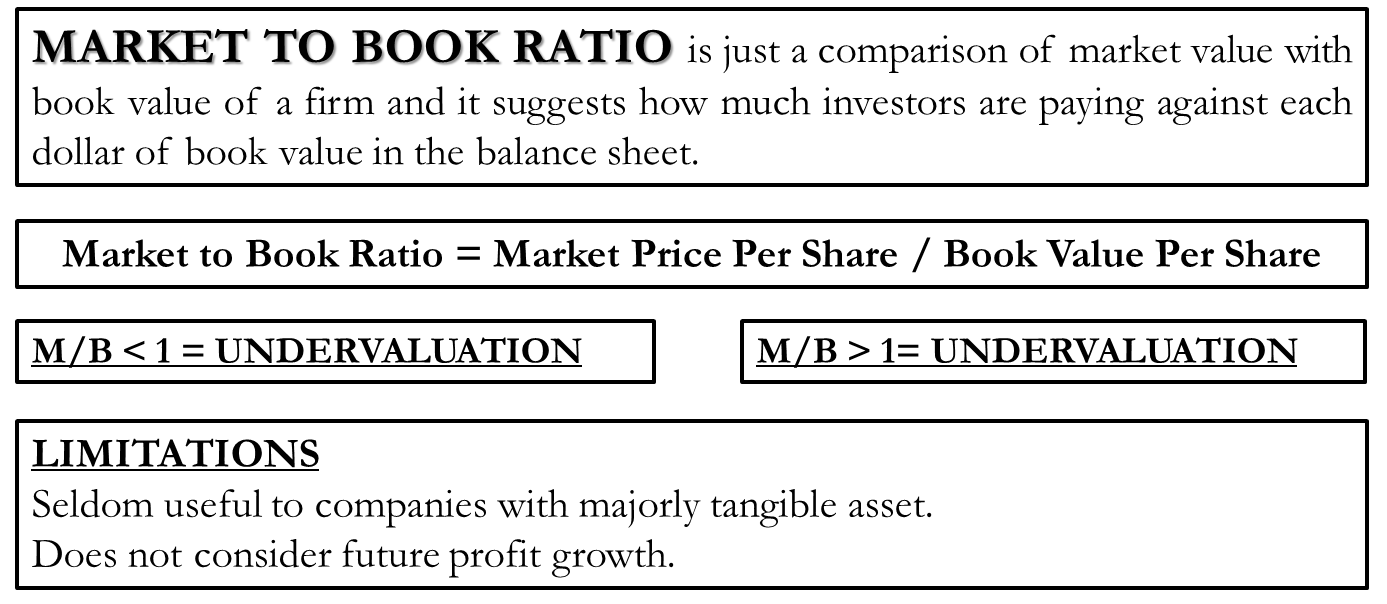

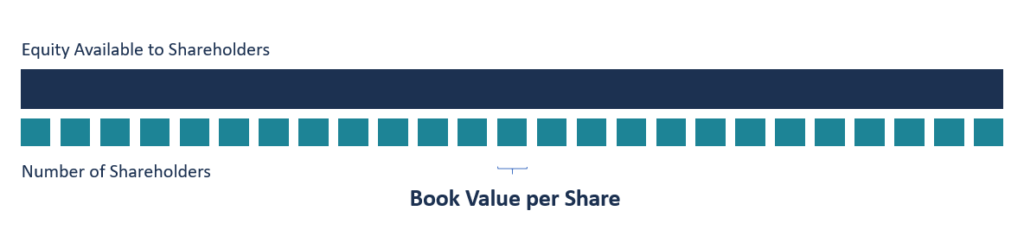

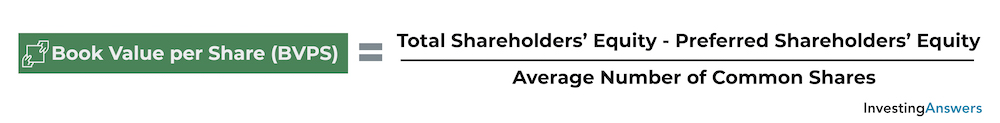

Tangible book value per share negative. Tangible book value per share tbvps is a method by which a company s value is determined on a per share basis by measuring its equity without the inclusion of any intangible assets. If there were 1 million shares of stock it would have a negative value of 1 00 per share. Net tangible assets per share is calculated by taking a company s net tangible asset number and dividing it by the total number of shares outstanding.

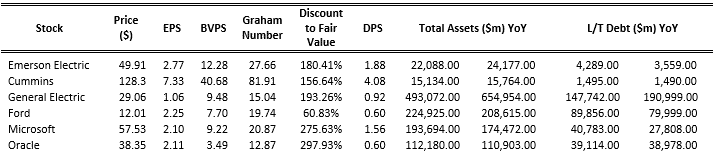

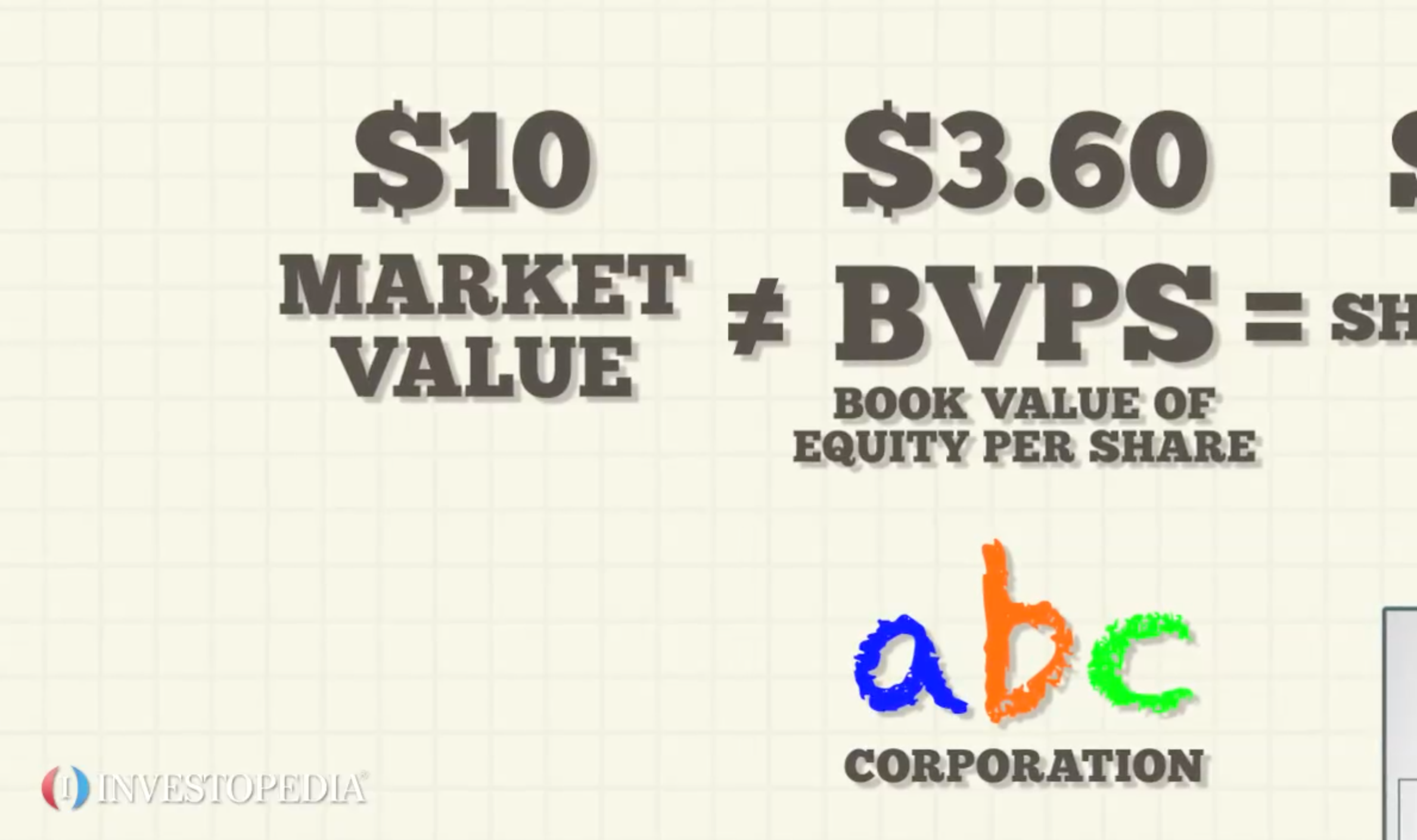

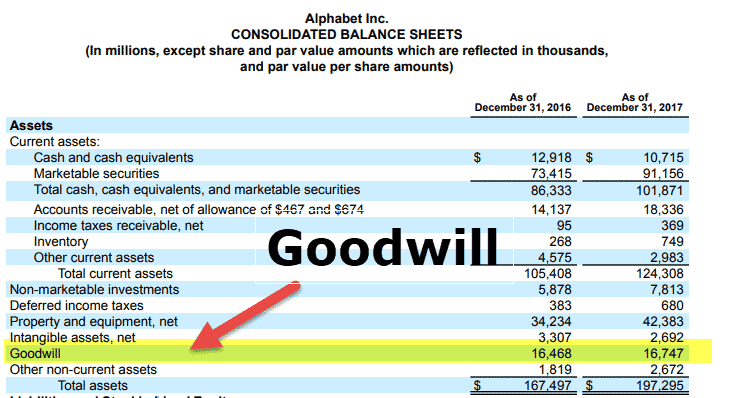

Price to tangible book value share price tangible book value per share for example let s assume that company xyz has 10 000 000 shares outstanding which are trading at 3 per share. The tbv excludes a firm s intellectual property patents and trademarks because these are intangible assets that cannot be easily sold such as property plant and equipment. Patents goodwill and liabilities.

Since preferred stockholders have a higher claim on assets and earnings than. Book value is also the tangible net asset value of a company calculated as total assets minus intangible assets e g. Understanding price to tangible book value ptbv in theory a stock s tangible book value per share represents the amount of money an investor would receive for each share if a company were to.

An asset s book value is equal to its. I assume that since the stock is rated as enterprising the tbvps is positive and that the goodwill line item was used. If book value is negative where a company s liabilities exceed its assets this is known as a balance sheet insolvency.

If i used the goodwill line item instead then the tbvps becomes positive. The tangible book value per share tbvps shows the amount per share that shareholders would expect if the firm was liquidated today. If they have 1 million in cash equipment accounts receivable and they owe 2 million for bonds and accounts payable there would be a negative value.

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)

/GettyImages-515784409-02fa255b131945c398fc6ffdedb99095.jpg)