Book Value Per Share Yahoo Finance

If the book value per share is higher than the market value per share then this stock might be undervalued.

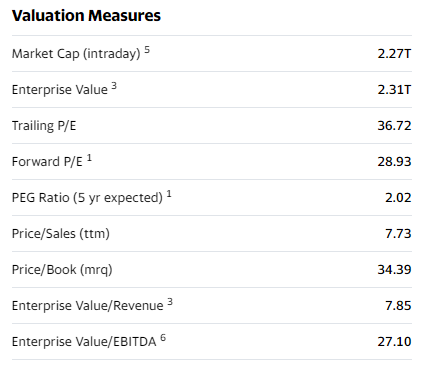

Book value per share yahoo finance. The next day the market price drops and the p b ratio is less than 1 meaning market value is less than book value. Current ratio mrq 1 36. It stands for earnings per share of the trailing twelve months and it works as a good marker for how successful a company is doing.

It also lets the investor calculate p e ratio by using the share price. Book value per share mrq 3 85. Where book value per share equals shareholders equity divided by number of shares outstanding so one day a company can have a p b of 1 meaning that bv and mv are equal.

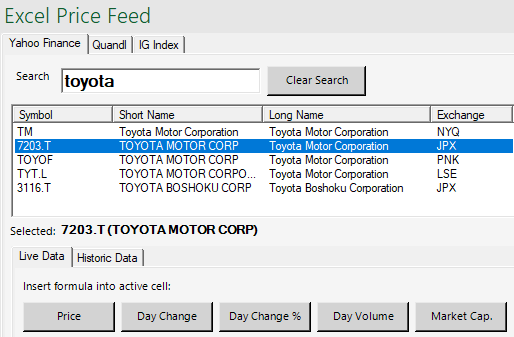

Yes q2 5 71 for every. Shareholder s equity preferred stock average outstanding common stock. Get access to 40 years of historical data with yahoo finance premium.

Operating cash flow ttm 2 56b. Of common shares issued less the 2 000 treasury shares. Otherwise the book value per share is 160 000 divided by the no.

Book value per share mrq 47 14. Total cash per share mrq 5 35. Book value per share is calculated as.

Get access to 40 years of historical data with yahoo finance premium. Note it s the number of common shares issued not the dollar value. Get access to 40 years of historical data with yahoo finance premium.