Book Value Per Share Of Common Stock Calculator

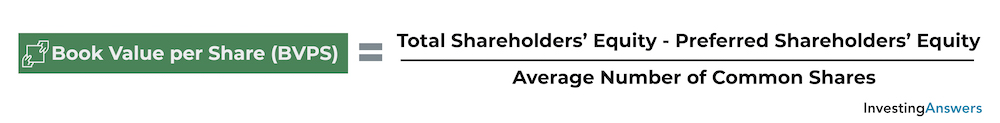

The formula for calculating the book value per share of common stock is.

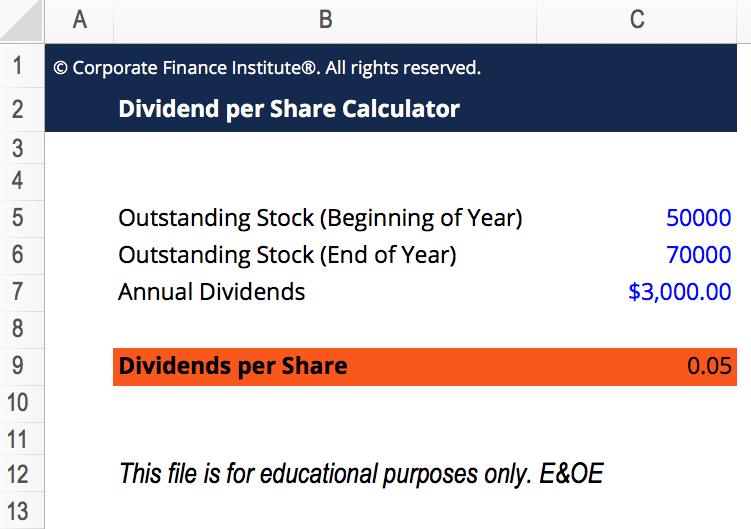

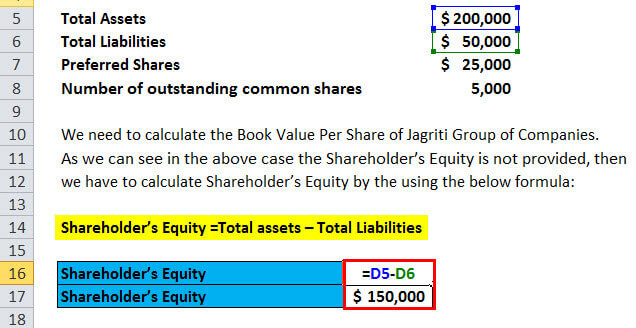

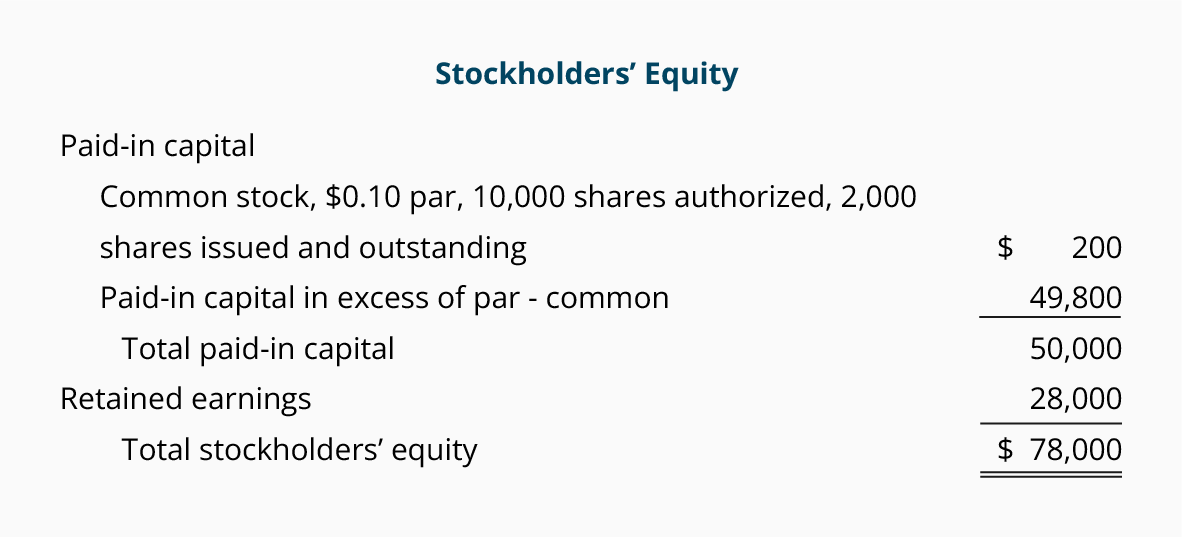

Book value per share of common stock calculator. In our example 80 000 divided by 50 000 shares equals a book value per share of common stock of 1 60. In the example 100 000 minus 20 000 equals 80 000 of available equity. The book value per share is the value each share would be worth if the company were to be liquidated all the bills paid and the assets distributed.

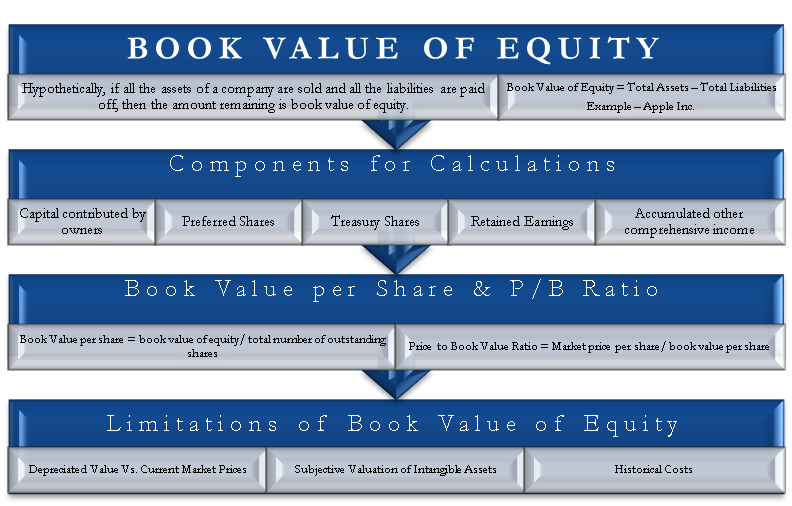

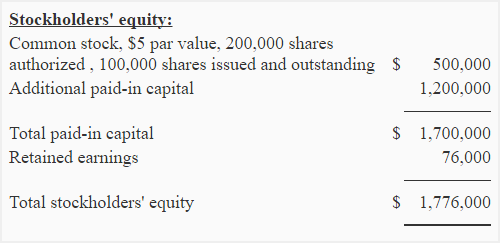

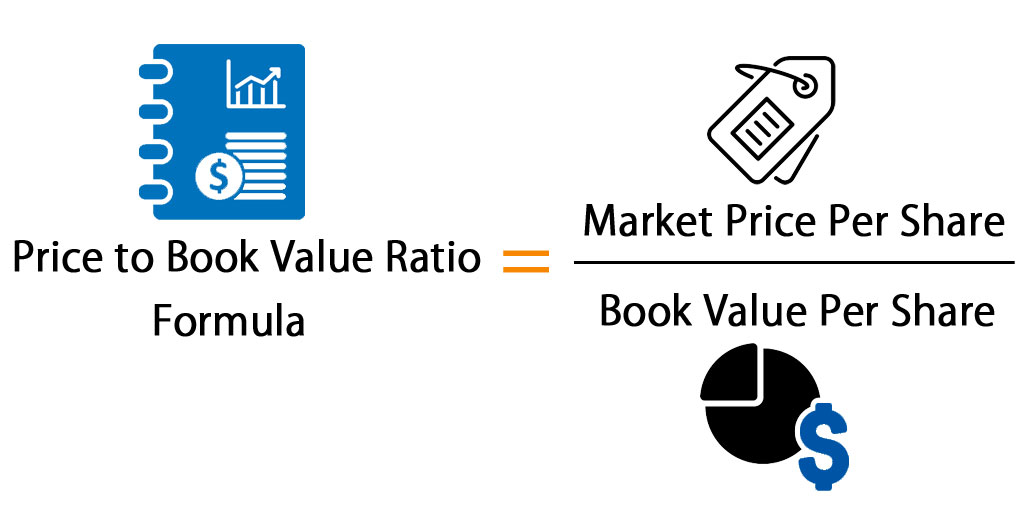

Formula of book value per common share. Use of price to book value formula the price to book value formula can be used by investors to show how the market perceives the value of a particular stock to be. Book value per common share calculation.

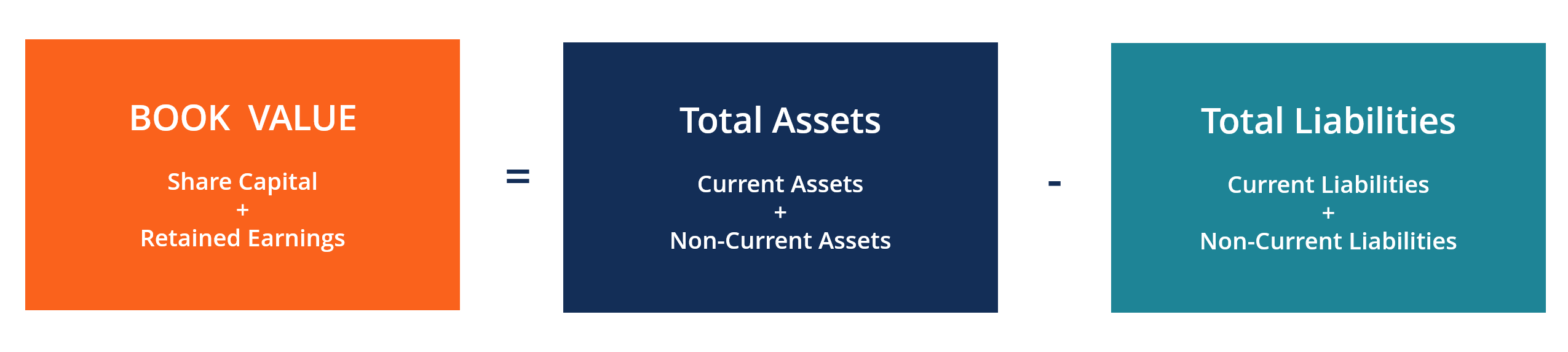

Book value per share stock holders equity preferred stock total outstanding shares. It is calculated by the company as shareholders equity book value divided by the number of shares outstanding. The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders.

Book value per share calculator for common stock this calculator will compute the book value per share for a company s common stock given the total shareholders equity the liquidation value of any preferred stock the amount of preferred dividends in arrears and the number of shares of common stock outstanding. The term book value is a company s assets minus its liabilities and is sometimes referred to as stockholder s equity owner s equity shareholder s equity or simply equity. The book value per share bvps is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding.

Book value per common share calculator online finance calculator which helps to calculate the book value per share from the values of stack holders equity preferred stock and total outstanding shares. Divide the available equity by the common shares outstanding to determine the book value per share of common stock. When compared to the current market value per share the book value per share can provide information on how a company s stock is valued.

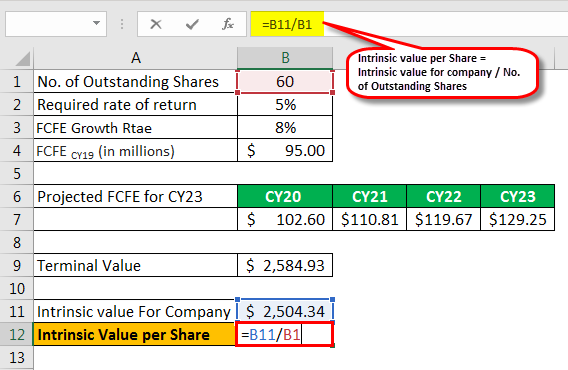

If the value of bvps exceeds the market value per share the. To illustrate how to calculate stock value using the dividend growth model formula if a stock had a current dividend price of 0 56 and a growth rate of 1 300 and your required rate of return was 7 200 the following calculation indicates the most you would want to pay for this stock would be 9 61 per share.

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)