Book Value Per Share Minority Interest

The correct value is lower.

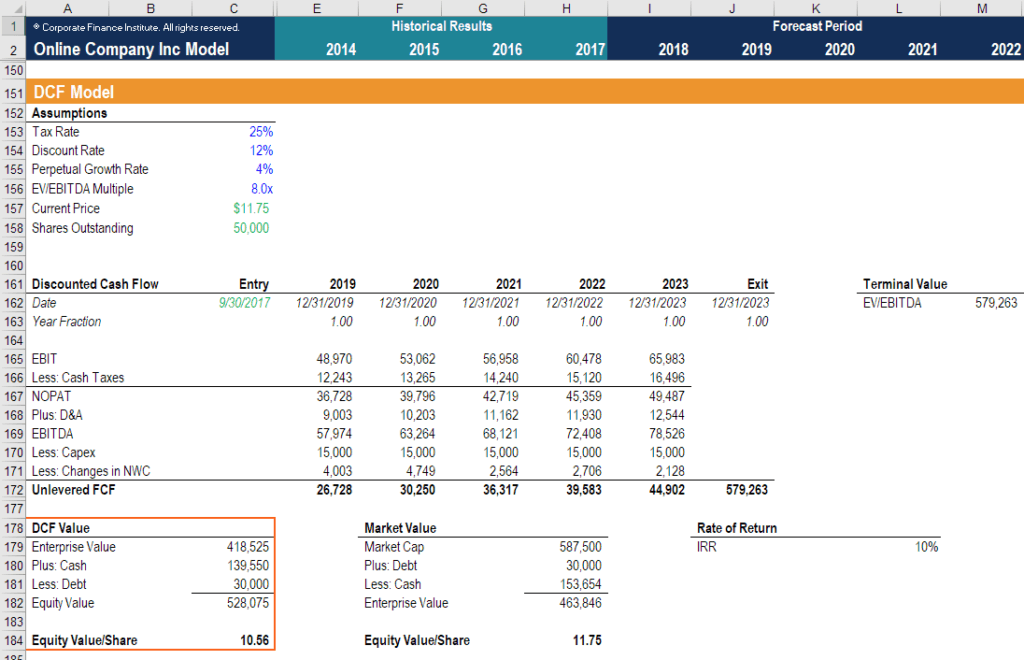

Book value per share minority interest. Enterprise value has to be adjusted by adding minority interest to account for consolidated reporting on the income statement. It is also known as non controlling interest. Kinder morgan kmi which had a total of 10 billion in minority interest liability removed from shareholder value in 2012.

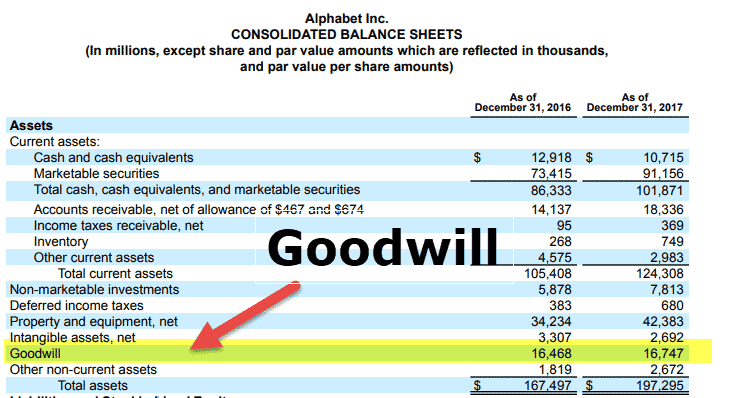

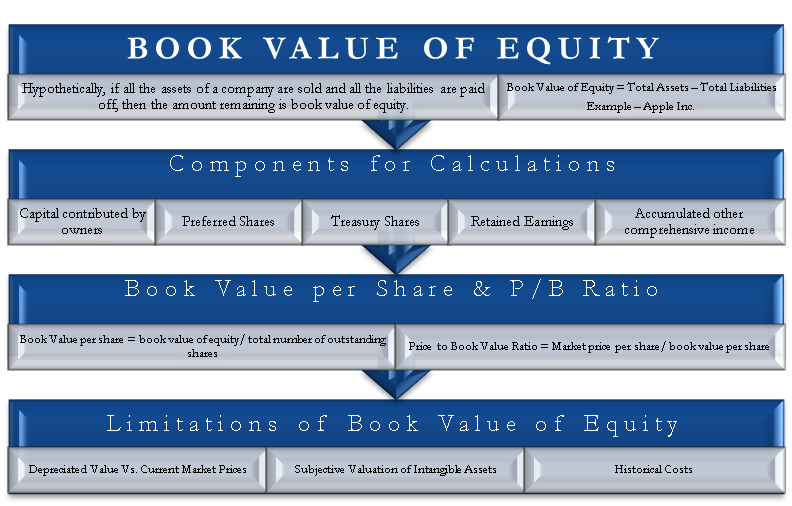

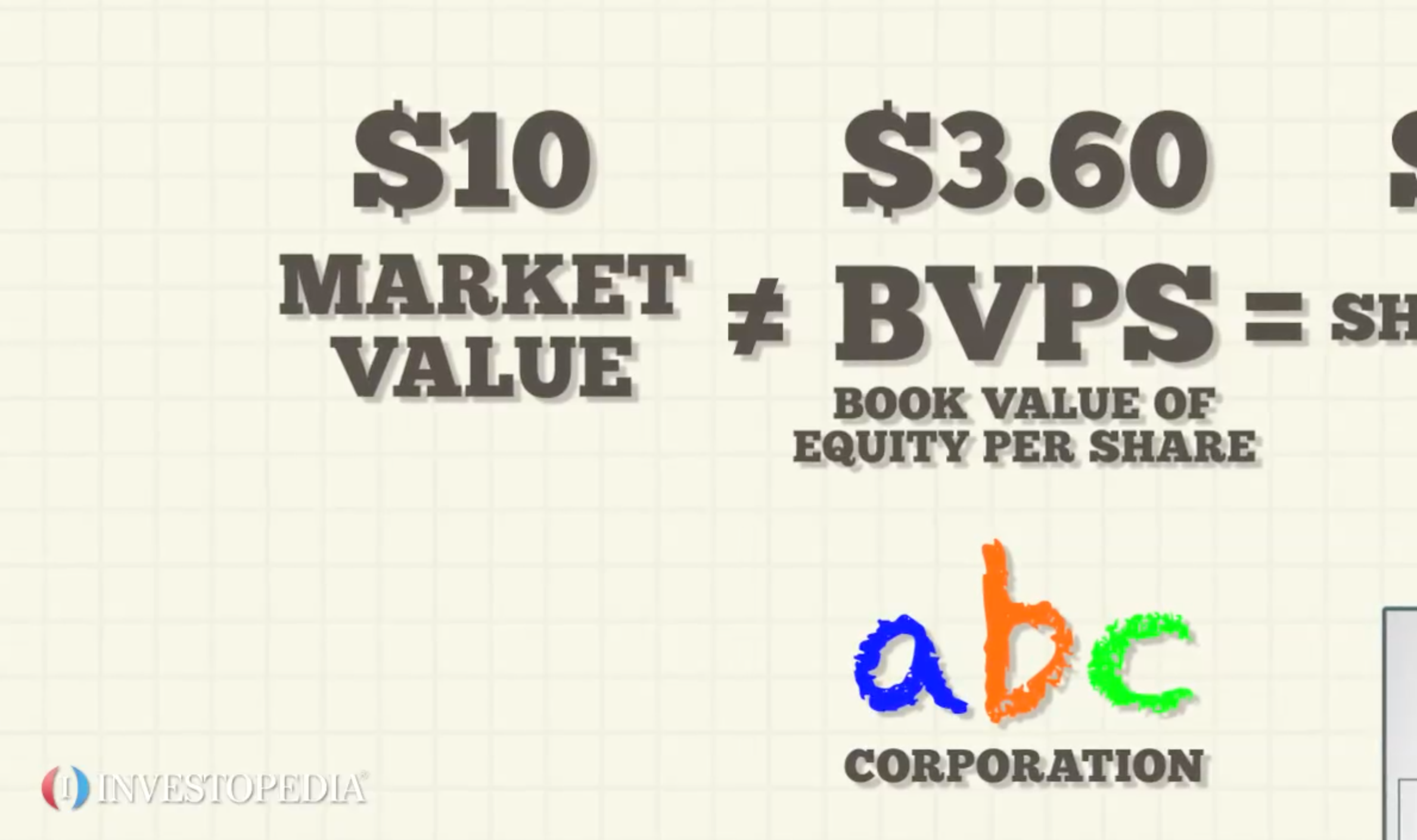

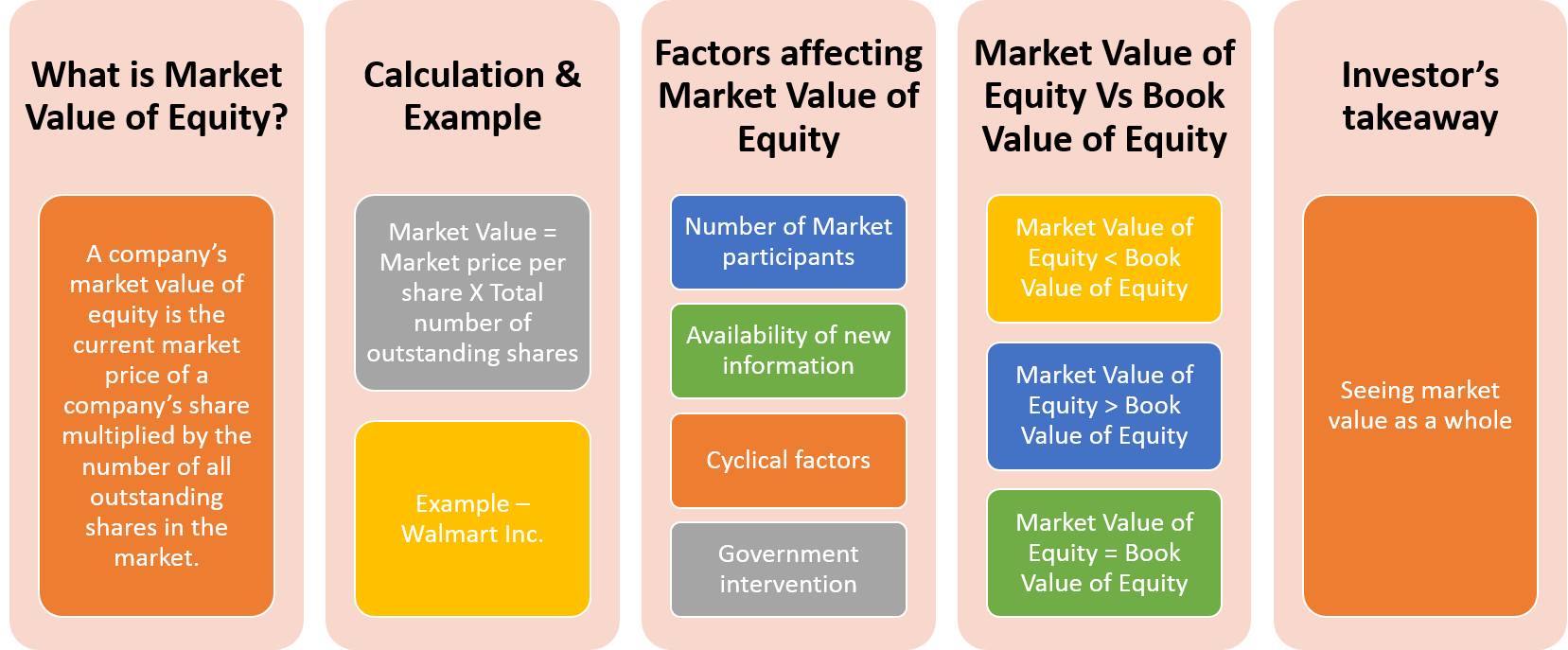

Proponents of using book values of the subsidiary s net assets view consolidated financial statements from the parent s viewpoint. The term book value is a company s assets minus its liabilities and is sometimes referred to as stockholder s equity owner s equity shareholder s equity or simply equity. Its economic book value or no growth value per share also dropped from 2 share to a negative 8 share.

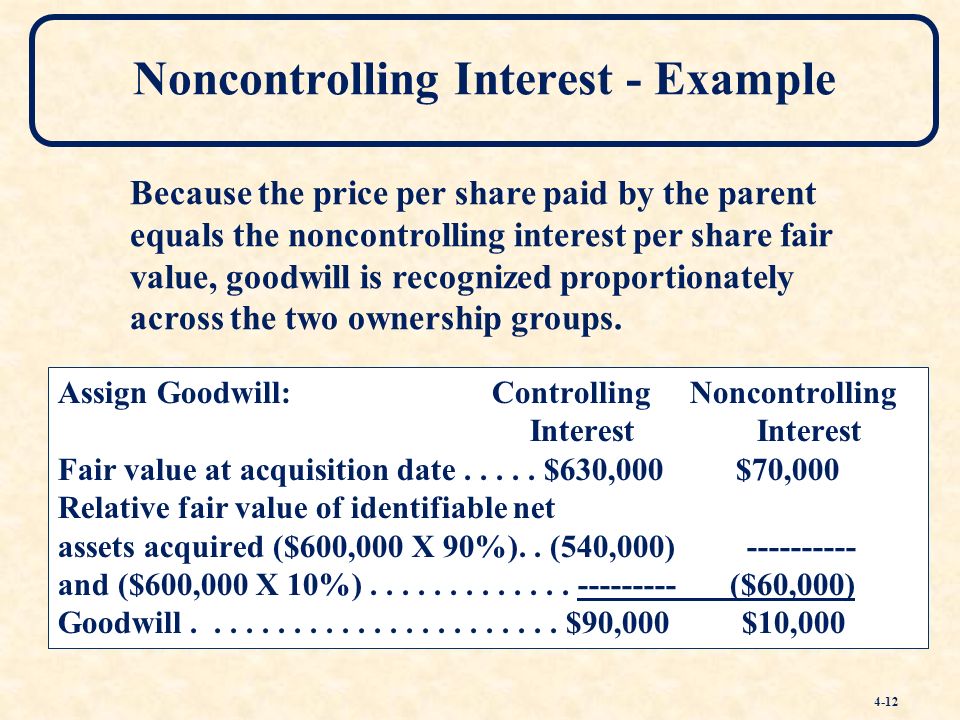

Minority interest is the ownership of less than 50 percent of a subsidiary s equity by an. Learn more about how to calculate this ratio what it tells you and how investors use it to guide their decisions. Minority interest of 140 000 2 700 000.

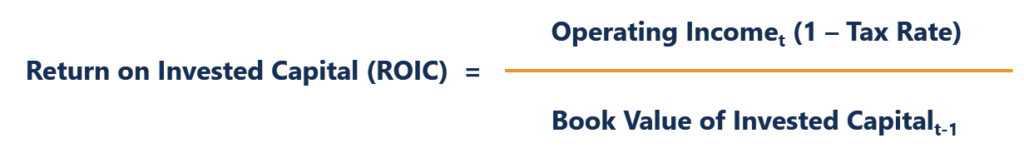

The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders. Next multiply that book value by the percentage. In other words this measures a company s total assets minus its total liabilities on a per share basis.

When a company owns more than 50 but less than 100 of a subsidiary they record all 100 of that company s revenue costs and other income statement items even. Shareholders holding less than 50 of the total outstanding number of shares are known as minority shareholders. This adjustment lowered kmi s economic book value from 1 6 billion to 8 6 billion.

To calculate a parent company s interest share in a subsidiary the first step is the find the book value of that subsidiary on its balance sheet. We then multiply this book value by 100 90 10 which is the percentage of pcp owned by minority shareholders to arrive at the minority interest value of 55 2 million to be reported on. Book value per share is a way to measure the net asset value.

:max_bytes(150000):strip_icc()/GettyImages-10188160-d7657047525045728e3d437c8cb592f1.jpg)

/stocks-lrg-2-5bfc2b1d46e0fb0051bdcc6a.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)