Book Value Per Share Less Than Market Value Per Share

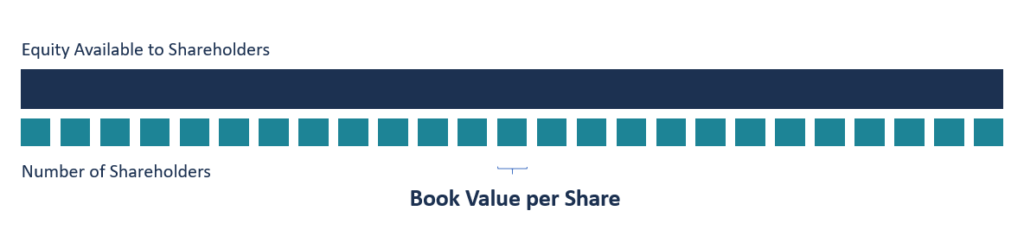

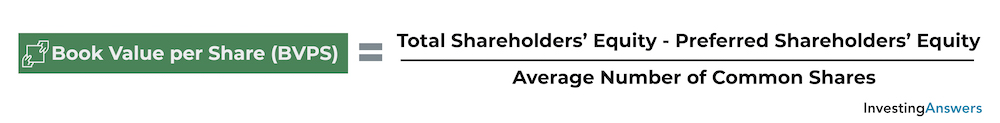

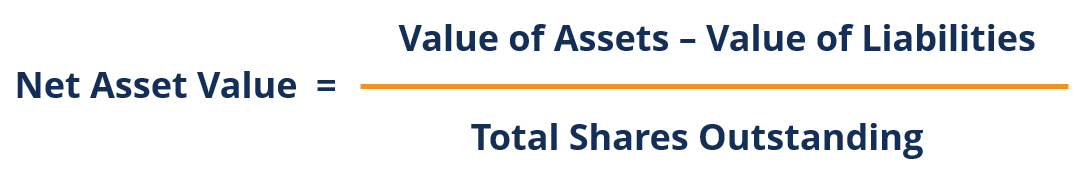

Book value per share is a ratio that compares the net asset value of a company minus preferred equity to the total number of common shares available on the market.

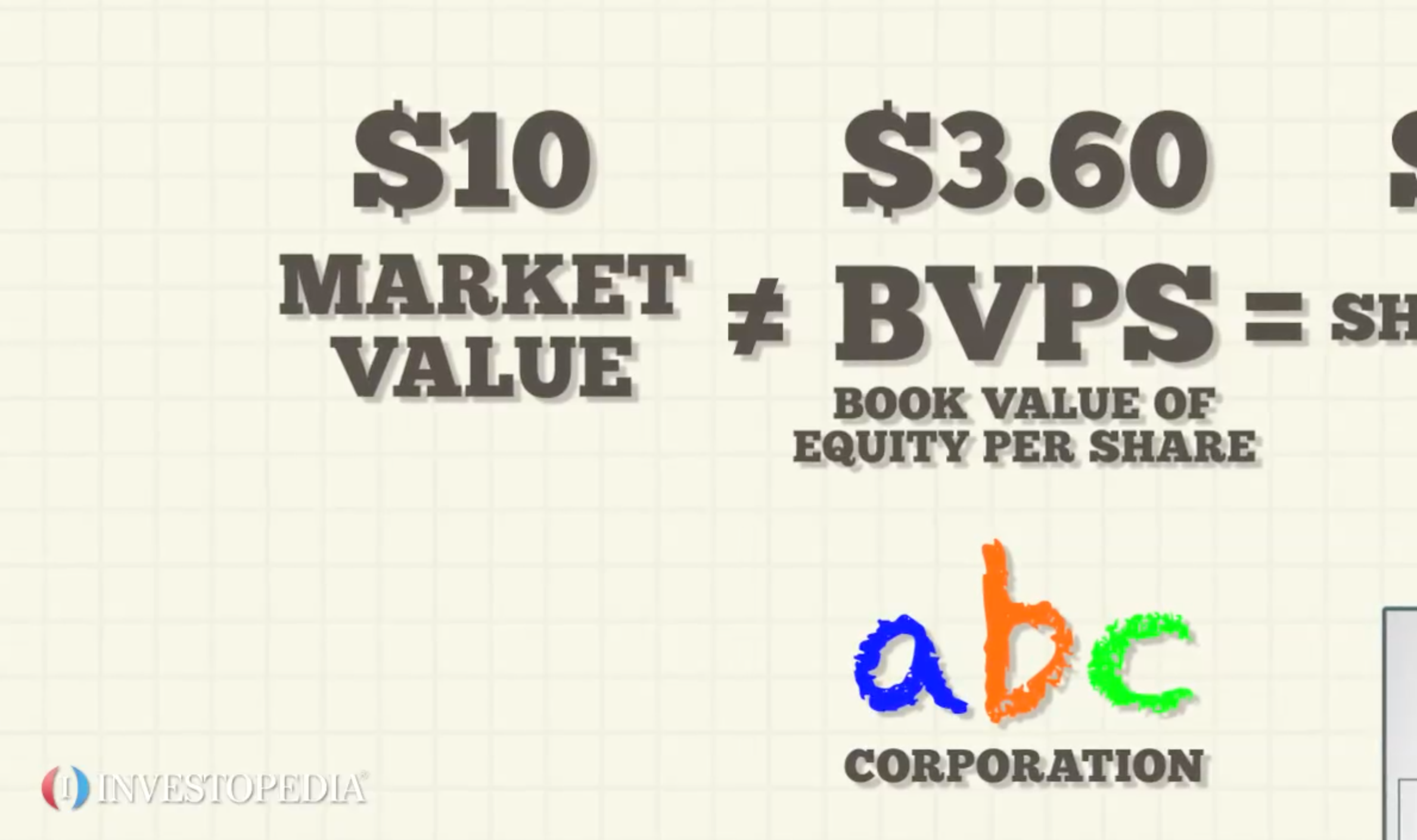

Book value per share less than market value per share. The next day the market price drops and the p b ratio is less than 1 meaning market value is less than book value. And finally the book value of a company is the total value of the company s assets that shareholders will receive in case the company gets liquidated. For example a company has a p b of.

Face value is the value of a company listed in its books of the company and share certificate. Comparing bvps to a stock s market price could help value investors find opportunities. The book value per share bvps is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding.

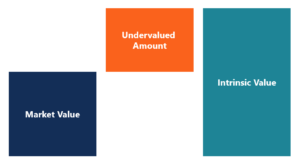

The price to book ratio formula is calculated by dividing the market price per share by book value per share. When compared to the current market value per share the book value per share can provide information on how a company s stock is valued. If the value of bvps exceeds the market value per share the.

Book value per share is a fairly conservative way to measure a stock s value. The price to book p b ratio is a popular way to compare market value and book value. The book value of a company stripped to basics is the value of the company the stockholders will own if the firm s.

The information needed to calculate bvps is found on a company s balance sheet. Apple stock closed on june 29 2018 at 185 11 per share. A simple calculation dividing the company s current stock price by its stated book value per share gives you the p b ratio.

The book value per share is a little more complicated. About 4 8 billion shares were outstanding at the time so the book value per share was about 23 96 per share. Market value per share is the current value at which the stock is trading in the market.

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)

:max_bytes(150000):strip_icc()/GettyImages-10188160-d7657047525045728e3d437c8cb592f1.jpg)

:max_bytes(150000):strip_icc()/GettyImages-667913740-556f3732481e4325a61448b8d957f044.jpg)

/ForcesThatMoveStockPrices2-d78bc38c16c743ffa0a8cf63184934a7.png)

:max_bytes(150000):strip_icc()/GettyImages-1058454392-146fd62a8b20476fa0888ecfa18868ae.jpg)

/dotdash_Final_What_Is_Treasury_Stock_Nov_2020-01-f5035e8520f7431ab833b13a155adbac.jpg)