Book Value Per Common Share Meaning

Book value per share is usually used to compute the value or price per share of.

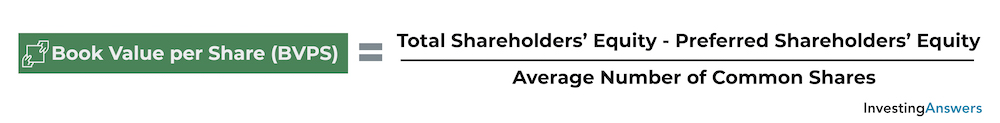

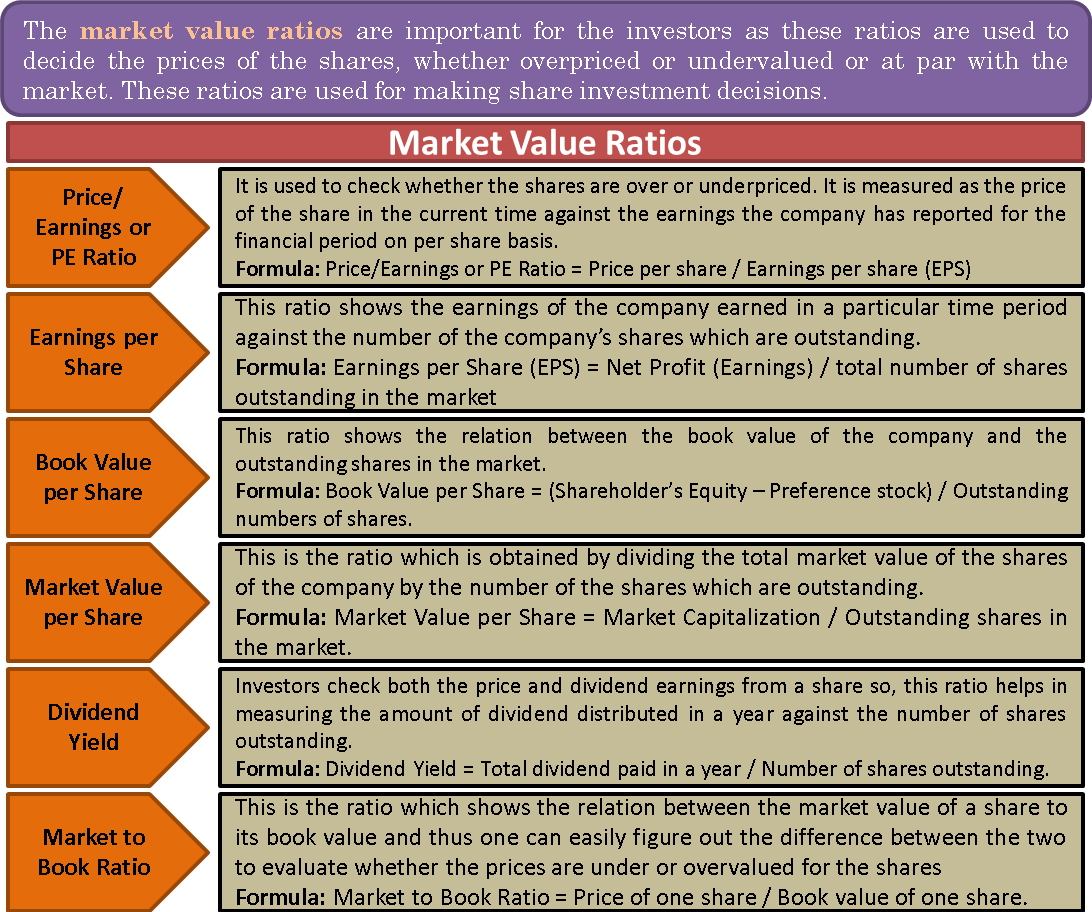

Book value per common share meaning. The formula for book value per share is to subtract preferred stock from stockholders equity and divide by the average number of shares outstanding. What does book value per share mean. Book value per common share or simply book value per share bvps is a method to calculate the per share book value of a company based on common shareholders equity in the company.

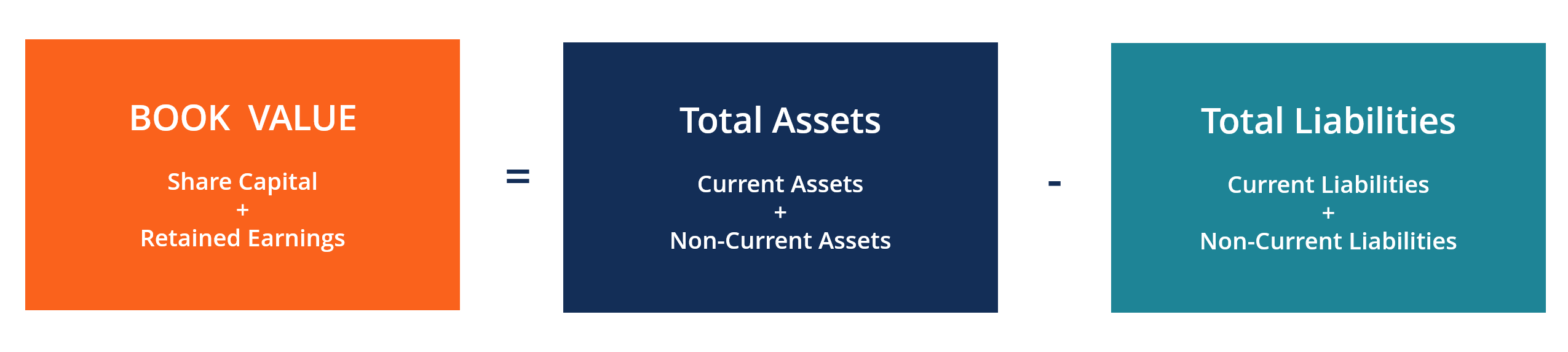

If book value per share is calculated with just common stock in the denominator then it results in a measure of the amount that a common shareholder would receive upon liquidation of the company. The term book value is a company s assets minus its liabilities and is sometimes referred to as stockholder s equity owner s equity shareholder s equity or simply equity. What is book value per share bvps.

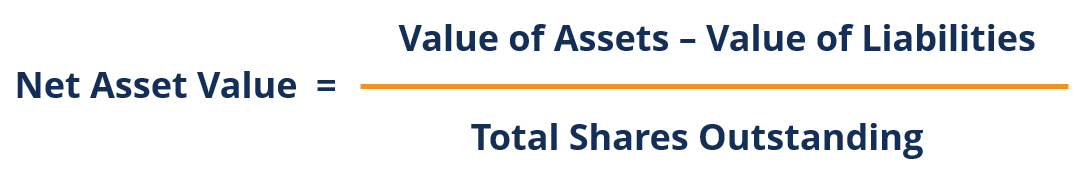

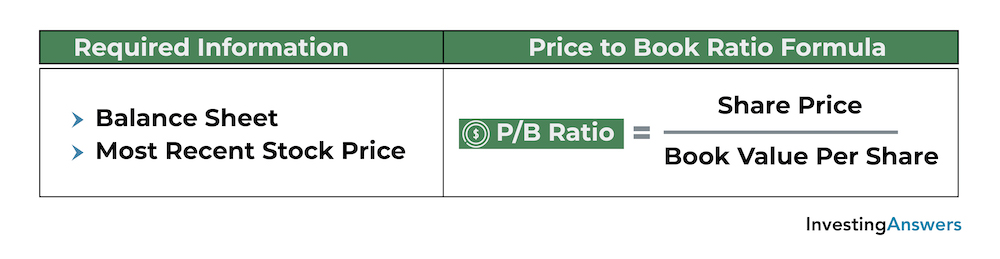

Comparing bvps to a stock s market price could help value investors find opportunities. The information needed to calculate bvps is found on a company s balance sheet. Book value per share is a ratio that compares the net asset value of a company minus preferred equity to the total number of common shares available on the market.

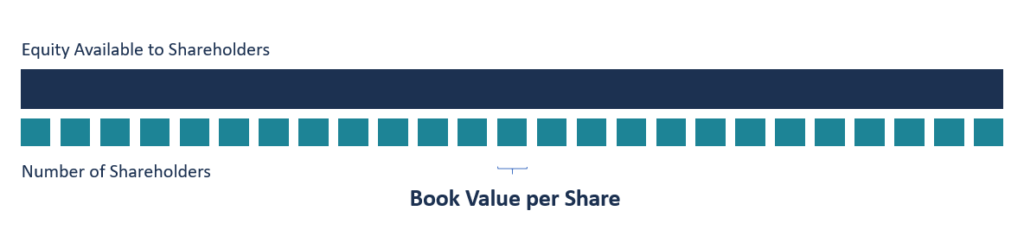

The book value per share formula is used to calculate the per share value of a company based on its equity available to common shareholders. Book value of equity per share bvps is the ratio of equity available to common shareholders divided by the number of outstanding shares. What is the book value per share bvps.

The book value per common share is a financial ratio that calculates amount of equity applicable to each outstanding common stock. The book value of a company stripped to basics is the value of the company the stockholders will own if the firm s. Since preferred stockholders have a higher claim on assets and earnings than common shareholders preferred equity is subtracted from shareholder s equity to derive the equity available to common shareholders.

The book value per share bvps is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding. Book value per common share calculates the per share value of a company based on common shareholders equity in the company. When compared to the current market value per share the book value per share can provide information on how a company s stock is valued.

:max_bytes(150000):strip_icc()/GettyImages-667913740-556f3732481e4325a61448b8d957f044.jpg)

:max_bytes(150000):strip_icc()/pb-5c41d8e3c9e77c000125d987.jpg)

/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

:max_bytes(150000):strip_icc()/shutterstock_18705301_market_book_library-5bfc478d46e0fb0051c4182e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_Treasury_Stock_Nov_2020-02-7f5fc89788a149369c685aefe0cf2782.jpg)

:max_bytes(150000):strip_icc()/GettyImages-10188160-d7657047525045728e3d437c8cb592f1.jpg)