Book Value Of Equity Google

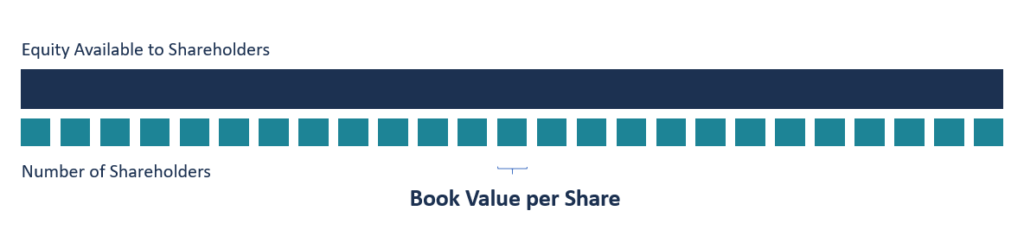

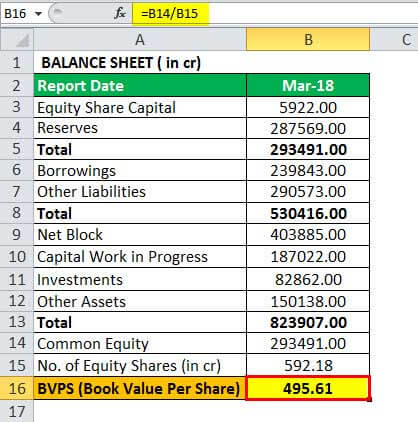

Book value of equity per share effectively indicates a firm s net asset value total assets total liabilities on a per share basis.

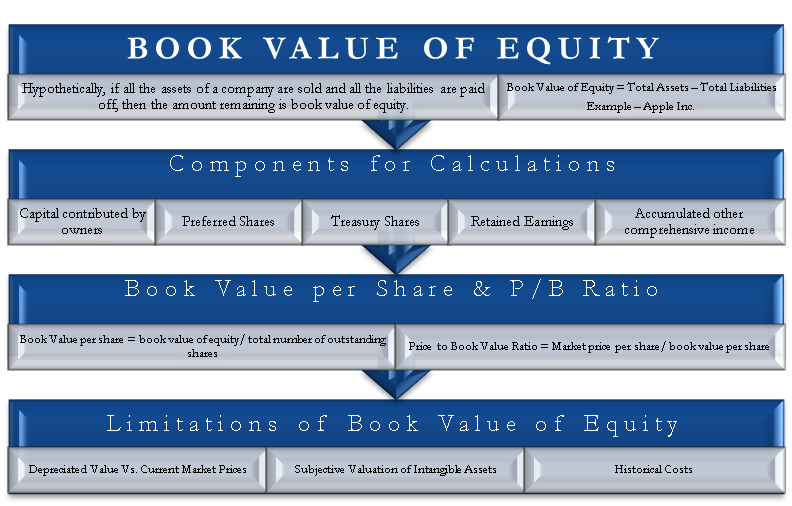

Book value of equity google. Book value of equity also known as shareholder s equity is a firm s common equity that represents the amount available for distribution to shareholders. Book value is equal to the value of the firm s equity while market value indicates the current market value of any firm or any asset. Put another way if a company were to close its doors sell its assets and pay off its debts the book value of equity is theoretically the amount that would remain to be divided up among the shareholders.

In other words as suggested by the term itself it is that value of asset which reflects in the balance sheet of a company or books of a company. Penerbit tentang privasi persyaratan bantuan tentang privasi persyaratan bantuan. Banyak pertanyaan yang saya terima tentang bagaimana cara mencari market value of equity di laporan keuangan.

Telusuri indeks buku teks paling komprehensif di dunia. Jadi di pos ini kita akan belajar cara mencari market value of equity. Should the company dissolve the book value per.

Book value of equity is an important concept because it helps in the interpretation of the financial health of a company or firm as it is the fair value of the residual assets after all the liabilities are paid off. Perlu teman teman ketahui bahwa m arket value of equity dalam bahasa indonesia adalah nilai pasar market value dari ekuitas equity. Dalam bahasa saham nya market value of equity itu s sama dengan kapitalisasi pasar market caps.

Anda pasti sudah sering mendengar istilah kapitalisasi pasar. Book value of equity is an estimate of the minimum shareholders equity of a company. From the perspective of an analyst or investor it is all the better if the balance sheet of the company is marked to market i e it captures the most current market value of the assets and the liabilities.

Book value of equity meaning the book value of equity more widely known as shareholder s equity is the amount remaining after all the assets of a company are sold and all the liabilities are paid off. Market value of equity mve merupakan salah satu analisa fundamental yang sering dicari oleh investor saham maupun untuk kepentingan data data lainnya. When a stock is undervalued it will have a higher book value.

:max_bytes(150000):strip_icc()/dotdash_Final_Market_Value_Added_MVA_Apr_2020-01-0552b692c94943a0bd80cd554965e002.jpg)