Book Value Minus Fair Value

The fair value of an asset is.

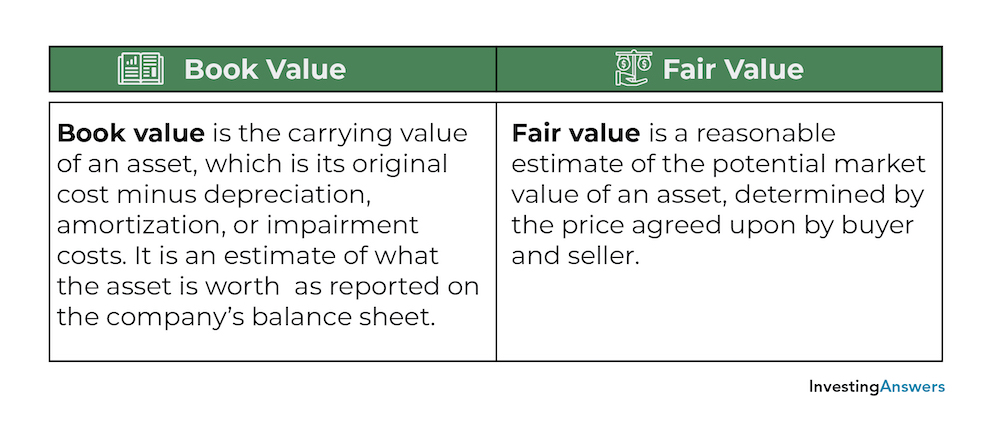

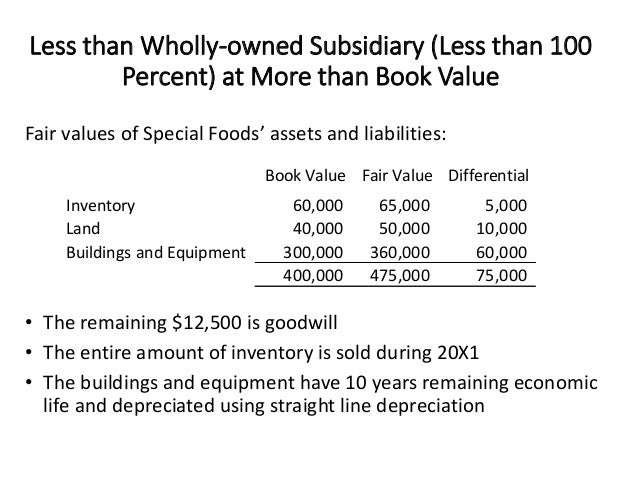

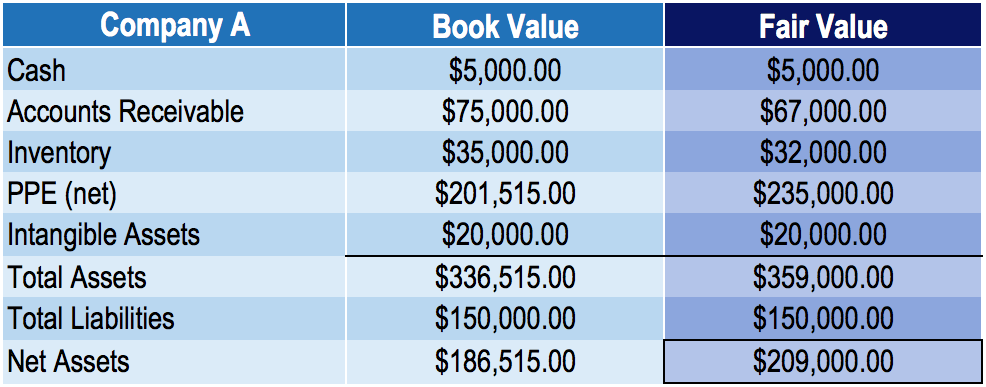

Book value minus fair value. In this article we will discuss book value vs fair value in detail and indicate their key distinctions. The two prices may or may not match depending on the type of asset. Therefore the calculation of book value per share will be as follows bvps total common shareholders equity preferred stock number of outstanding common shares 2 93 491 00 cr 592 18 cr.

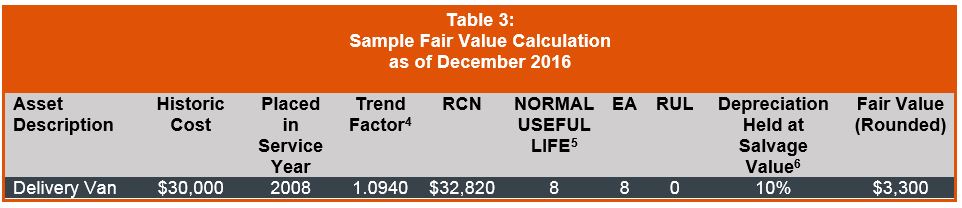

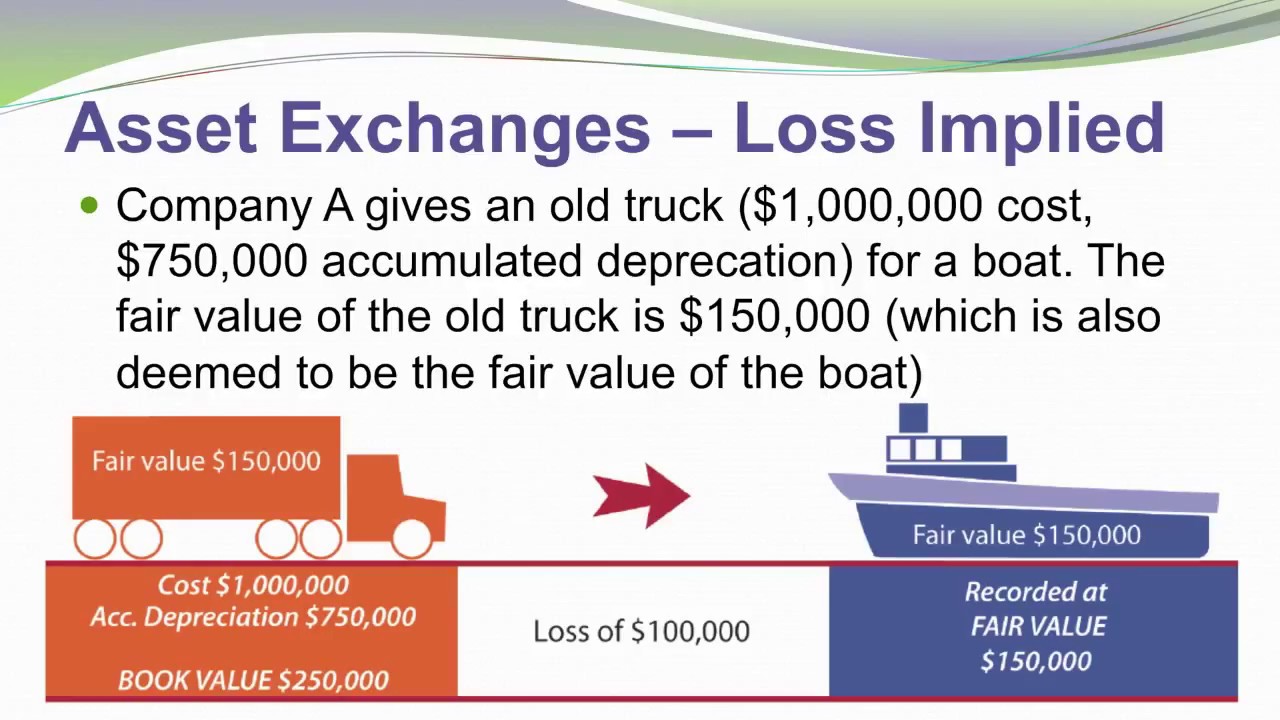

Typically fair value is the current price for which an asset could be sold on the open market. Net book value 1 the cost of an asset the amount that was paid for it minus accumulated depreciation for financial reporting purposes fair value asc 805 2 the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between marketplace participants at the measurement date. The company s balance sheet is where you ll find total asset value and for.

Book value is a metric that helps analysts and investors evaluate whether a stock is overpriced or underpriced when compared to the company s actual fair market value an estimate of the price for. You can use this book value calculator. Book value usually represents the actual price that the owner paid for the asset.

As an example consider this hypothetical balance sheet for a company that tracks the book value of its property plant and equipment it s common to group assets together like this. Book value indicates an asset s value that is recognized on the balance sheet. The carrying value or book value is an asset value based on the company s balance sheet which takes the cost of the asset and subtracts its depreciation over time.

The book value shown on the balance sheet is the book value for all assets in that specific category. Essentially book value is the original cost of an asset minus any depreciation depreciation expense depreciation expense is used to reduce the value of plant property and equipment to match its use and wear and tear over time. Book value per share will be bvps 495 61 book value calculator.

/GettyImages-1091470486-5b4ac16f07264b1a8b3738289324bfe5.jpg)

/dollar-544956_1920-8118965bd1014e7d989647b63db5f3b6.jpg)